U.S. pork finds growth abroad while domestic demand drags

Shipments help but will not be enough to overcome projected costs in the upper $80s or low $90s per cwt. carcass

August 14, 2023

Welcome to another installment of Dr. Demand here at NHF’s weekly update!

I don’t think it is a mystery to anyone why I spend so much time talking about demand. It is obviously a critical factor and pork and hog pricing. In addition, my turn to write this column usually follows just after USDA has released monthly export data for two months past, thus providing an update on export demand as well as the last piece of information I need to estimate per capita disappearance in the United States, a key factor in measuring domestic consumer-level pork demand.

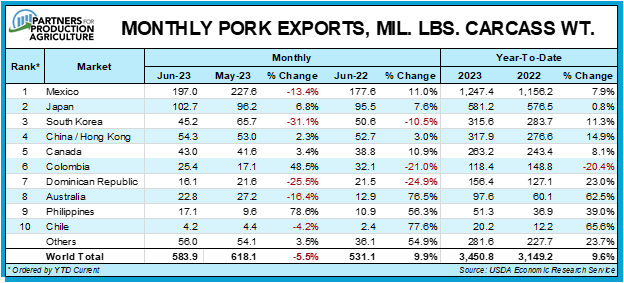

Let’s begin this week with the good. June pork exports were strong, slightly smaller (5.5%) than in May but 9.9% larger than last year. That performance brings the year-to-date total to 3.451 billion pounds, carcass weight, 9.% more than last year. See Figures 1 and 2.

Figure 1

Figure 2

Of our 10 leading markets, only Columbia has taken less pork this year than it did last year. Mexico is now officially twice as large as any other U.S. market and has taken 7.9% more U.S. pork this year. Even China/Hong Kong has grown by double digits versus 2022 through June.

Our colleague Brett Stuart at Global Agritrends has 2023 full-year exports up 9% from last year. We are clearly running a bit ahead of that pace now but I think that still looks quite reasonable. If it in fact happens, that growth will put 2023 U.S. exports at 6.9 billion pounds, third only to 2020 and 2021. That amount will represent 25.3% of our carcass weight pork production. You might see a larger percentage figure from National Pork Board and U.S. Meat Export Federation because their number adds in variety meats sales.

And prospects for further export growth are good. EU output is sharply lower this year and it is doubtful that will rebound in 2024 due to very high production costs and significant policy and social pressures.

Canada could increase shipments but we have to remember that their industry is about one-fifth as large as ours. The same but to a slightly lesser degree is true for Brazil.

So that leaves us as the primary supplier to any increase in imports by countries such as China! China hog prices have risen recently and we believe their supplies are low again but it is very difficult to gauge the status of China’s economy and thus consumer-level demand.

Still, I expect further growth for U.S. export in 2024 with a new record (ie. more than 7.282 billion pounds, carcass weight) quite possible.

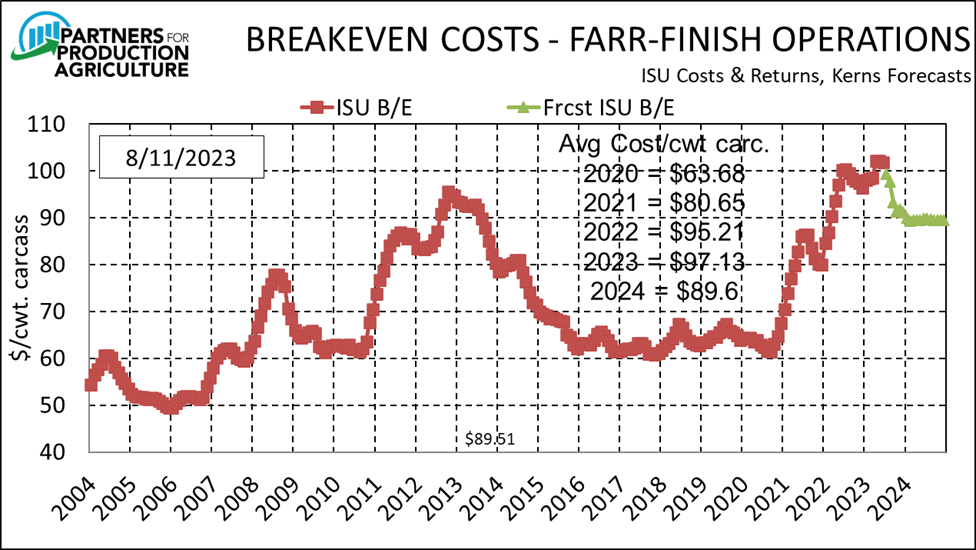

The important thing to keep in mind is that the 2023 increase in exports (9%, say) will reduce domestic pork availability by 562 million pounds or 1.9%. Similar growth in 2024 will take another 1.9% off our shores. Those shipments help our markets but will not be enough to overcome projected costs in the upper $80s or low $90s per cwt. carcass! See Figure 3.

Figure 3

And the news is still not great for consumer-level domestic pork demand – which accounts for the other 74.7% of U.S. production. June real per capita pork expenditures were roughly even with those of May but were 9% lower than one year ago. Year-to-date RPCE is now 10.6% lower than last year. See Figure 4. RPCEs for other species were also lower than one year ago thought by smaller percentages than was pork.

Figure 4

Every component of RPCE was softer than last year in June. Per capita consumption was down 3.1%, partially due to higher exports. The nominal retail price of pork was lower than one year ago for the fourth straight month, falling 5% versus last June. The real (i.e. deflated) price of pork was 7.8% lower than last year.

So why were wholesale and hog prices higher in June? My answer is: Prop 12. The announcement that non-compliant product in possession of packers and distributors on July 1 could be sold in California through Dec. 31 lit a fire under wholesale demand as companies tried to get product into inventory by the deadline. That drove the cutout value higher which created an incentive to harvest hogs and to chase them if necessary.

The fact that consumer level demand had not fallen more over the past 10 months provided some “space” for wholesale and hog demands to bounce back quickly. Had retail prices declined more, indicating softer consumer demand, I don’t think we would have seen this recovery nearly so quickly.

And July? And August? The jury is still out on those. The effort to secure inventories by July 1 no doubt left some voids in wholesale supply chains that were backfilled in July. So strong wholesale and hog demand past July 1 did not surprise me. But I honestly thought that would be over by now and yet we still have a cutout value over $110, the net price of all barrows/gilts over $102 and the national spot weighted average price nearly $96.

It is possible that fundamental wholesale demand, independent of the Prop 12 situation, has strengthened but there is not, in my opinion, enough data to clearly draw that conclusion yet. Should this strength remain through the end of August, I think it will be time to make that call as the industry should be far enough away from the changes driven by the June Prop-12 announcement.

About the Author(s)

You May Also Like