Strike three for the corn bulls

Both pork and poultry are forecast to be a bit higher, but the overall contribution of the protein accretion industry to the corn balance sheet is lower production

October 16, 2023

Mr. October, Reggie Jackson, is nowhere to be found for the corn bulls.

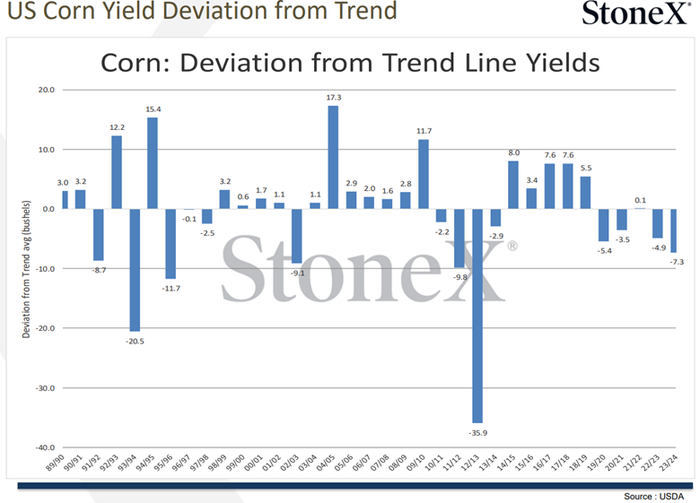

Pork producers took a kick to the shins last week when the USDA crop report truncated the crop just a bit more. This is the second year in a row where yields have fallen well off trendline projections – this is actually the fourth year out of five with 2021 harvest right at trendline yield. Still, the balance sheet remains rather comfortable in the face of the reduction in production. Corn future rallied briefly after the report and have since settled down. This market action with the smaller production begs the obvious question – how low can prices go if we ever get good weather? Lets take a look at the parameters.

We only have three places we can go with corn and one (exports) is full of competition. The attached data from the USDA report provides little hope for the would-be corn bulls as it relates to domestic feeding. Note that beef production is projected to be down a whopping 1.7 billion pounds year over year. Both pork and poultry are forecast to be a bit higher, but the overall contribution of the protein accretion industry to the corn balance sheet is lower production (and, hence, lower corn use). Keep in mind that beef conversion is the worst of the three major proteins so the impact to the corn balance sheet is disproportionately negative. Strike one.

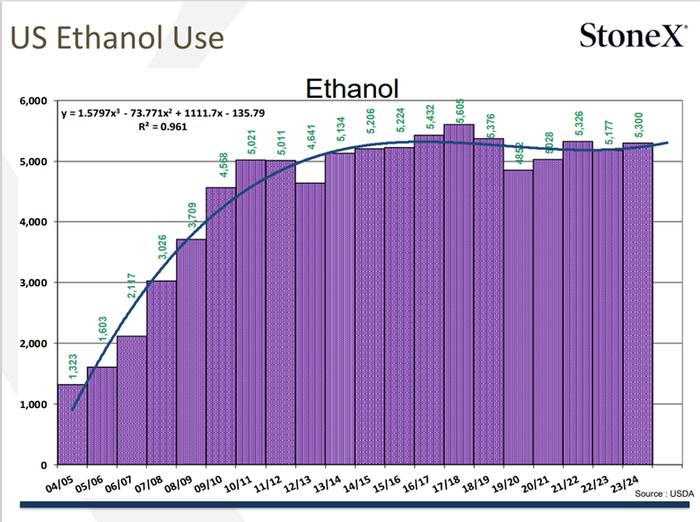

Ethanol grind is static. As in so flat that it is nearly impossible to move the needle on corn disappearance. We have a fixed grind capacity and both governmental policy and economics dictate that we keep our foot to the floor with ethanol production. Margins are favorable and even if the price of crude oil were to jump precipitously and encourage more production, we simply do not have the capacity to comply. Make no mistake, this situation would put more teeth into the ethanol monster when it comes to competing for you with corn basis. Higher price crude oil would result in higher priced ethanol and more profits for that sector which would allow them to pay more premiums and still have favorable margins, their grind pace would still remain relatively static in an increased margin environment. Strike two.

This leaves us with exports as the only viable place where corn demand has a chance to tighten the balance sheet. That is not a likely prospect. Consider that the USDA has been eating crow on the prospects of U.S. corn exports for about the last 18 months. The chart below depicts the monthly projections of U.S. and Brazilian corn exports over time. Note that in May of 2022, they thought the U.S. would be a robust shipper of corn, totaling 2.4 billion bushels while Brazil would be a bit player at roughly 1.85 billion bushels. That expectation moderated a bit over time with a significant recognition of the error in February where the trajectory of the Brazilian program launched higher at the same time US participation faded.

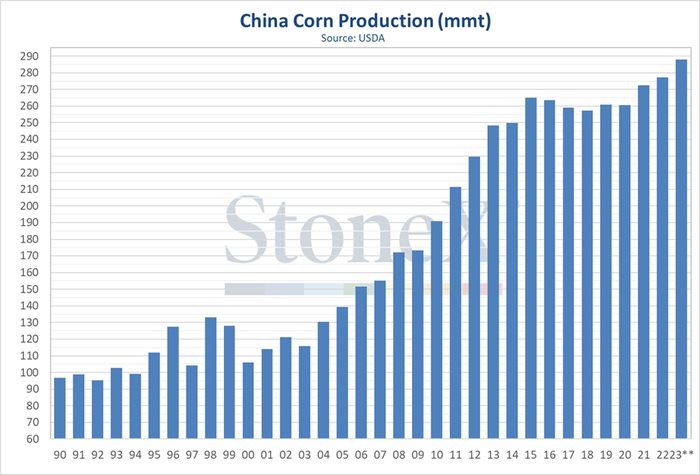

The current USDA forecast for the crop being harvested is a seemingly unrealistic rebound back to over 2 billion bushels of shipments while forecasting a carryout of over 2.1 billion bushels at the same time. In my opinion, there is only one way for corn exports to go – down. This should leave us plenty of buffer in the U.S. balance sheet and keep a lid on prices. By the way, the prospects of the Chinese crop were quietly raised 11 mmt versus last year to a record 288 mmt. One more potential export destination that is not quite as shiny of a prospect. Strike three for the bulls.

The grain bulls have a much more legitimate argument in the soy complex. The recent balance sheet was an uncomfortable “unchanged” on the bottom line as the integration of higher stocks from the September report were offset by yield losses in this year’s crop. Make no mistake, we will hyper sensitive to any deviations in the South American crop that may mean that the U.S. has to participate in export markets beyond Feb. 1. China is woefully underbought for the Dec-Feb timeframe and is seemingly playing a game of chicken in anticipation that Brazil – by far their supplier of choice – is somehow able to keep competitive for an extended period of time. This real-world gamesmanship has the power to pivot the U.S. soy balance table one way or the other.

On the revenue side of our business, the October contract went off the board with a similar modicum of strength that we witnessed with the July and then the subsequent August contract. Sustained weekly harvest numbers in excess of 2.6 million may weigh on the December contract to a larger degree, domestic and export demand have been resilient. It seems to me if we can just gut through the balance of the year and hold on to some slim margins availed for 2024 that things will, indeed, get better. Look no farther than the rapid decline of production in the EU, our primary competitor in the export market, for your evidence of hope. Late spring to summer markets in the mid-90s offer profits that should mark the end of our sustained downdraw of capital, better days should follow thereafter.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns via email.

About the Author(s)

You May Also Like