Facts and conclusions

With soft demand, plenty of pigs and competition from other species, China appears to be in same boat as U.S. pork industry.

November 13, 2023

Let’s begin today with what I believe to be clear facts about current market conditions.

Fact 1

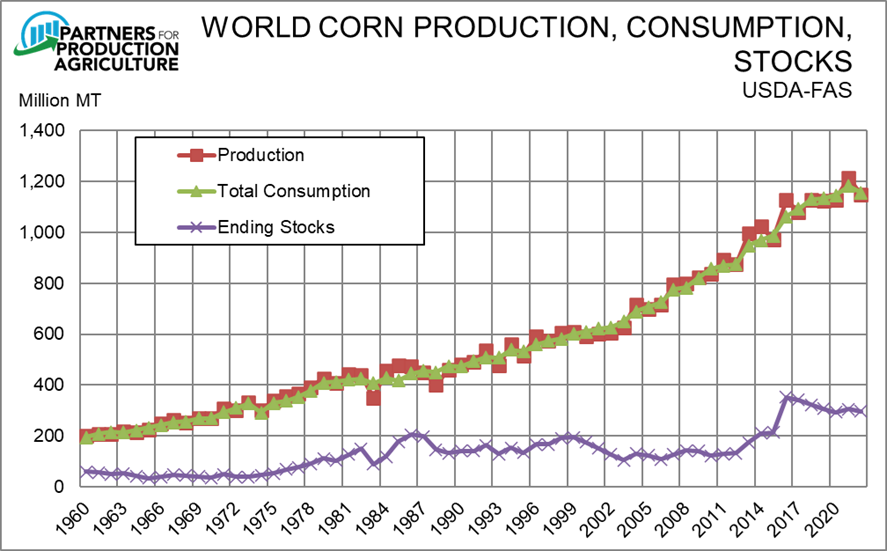

World grain supplies are ample and still growing. See Figures 1 and 2. The pace of growth has slowed for both corn and soybeans since 2017 but it still positive. Concurrent growth in consumption has kept world corn and soybean stocks constant since that time – but constant near the record levels seen for corn in 2016 and soybeans in 2018. These levels have been maintained even as U.S. and South American crops have been just so-so in most years and, in the case of Argentina’s soybean crop in 2023, sometimes poor. Good weather and more acres in Brazil could push these output figures higher, possibly at a faster rate than in recent years.

Figure 1

Figure 2

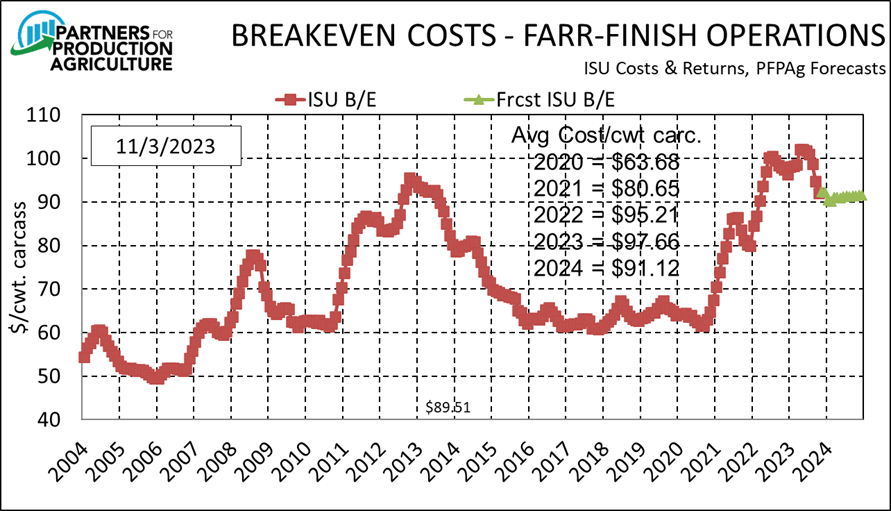

Fact 2

Costs are indeed lower but are still 40% higher than prior to 2021. See Figure 3. Costs through October 2023 are from Iowa State University’s Estimated Costs and Returns series for Iowa farrow-to-finish operations. Forecasts for November 2023 through 2024 are from a regression equation computed by me using corn and soybean meal futures prices to predict those costs levels. Anecdotal evidence says that the ISU estimates and thus my forecasts would be $5-$7 per cwt. lower than the costs of average U.S. farrow-to-finish operations. So these imply costs for average producers are in the upper $90s for 2024.

Figure 3

Fact 3

U.S. hog prices are good relative to history. See Figure 4. Of the 238 monthly prices in Figure 4, last week’s price ranked 75th. The $101.65 for July ranked 15th. Prices implied for November through the end of 2024 by LH futures last Friday are virtually all higher than the 20-year average of $75.86.

Figure 4

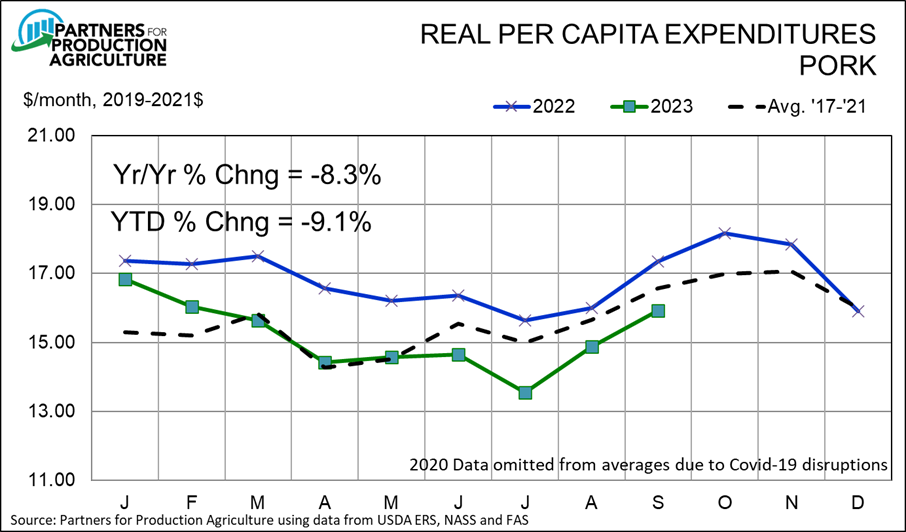

Fact 4

U.S. consumer-level pork demand is still soft relative to the past two years but comparable to 2019-2020. See Figure 5. Real per capita expenditures for pork were still down 8.3% versus 2022 in September and year-to-date RPCE is still down 9% but the monthly gains since a disastrous July have been better than normal.

Figure 5

Fact 5

Exports have provided significant support to U.S. wholesale pork prices in 2023 but their impact has waned somewhat in recent months. YTD shipments are up 7.2% through September and are on pace to be the third largest annual total in history. But September shipments were 0.2% lower than last year, likely due to higher U.S. prices since July. Will lower Q4 prices help? Very likely and I still think this is a very positive story for the U.S. pork sector this year. Forecast growth for 2024 is in the 1 to 4% range implying that further support may be limited.

So what is to be drawn from these facts?

Conclusion 1

Feed costs are primarily demand driven. Some of that demand is from livestock and poultry since output prices are positive driver of input demand. Hog prices have been good but so, too have cattle and poultry prices. The big factor though is carbon policy and its positive impact on the values of fats and oils. Just think of those as “energy” and it is easy to see how those values have pushed up the value of all sources of feed energy, including corn. Add in the positive impact on soybean prices and the competition that provides for land resources and it is clear to see. The question is whether this demand will decline and, if so, how quickly. I don’t expect it to decline much if any as I expect these carbon policies are here to stay. Perhaps world supplies can grow fast enough to push feed prices lower but it appears to me that the demand side will remain firm.

Conclusion 2

Don’t forget the role of non-feed inputs on costs. Dr. Lee Shulz added $7/head to ISU’s total costs for higher non-feed variable costs in 2022 and another nearly $3/head in 2023. He also added $8/head for higher fixed costs in his 2023 update. That’s $18/head or about $8/cwt. that isn’t impacted by grain prices. I wouldn’t be surprised to see the non-feed variable costs grow again when Dr. Shulz re-indexes them in January 2024.

Conclusion 3:

Demand is lower and the robust levels of 2021-2022 are not likely to return. The reason is that it appears those strong demand months were primarily driven by high consumer incomes and those were largely the result of government stimulus payments that are not likely to return. The timing of the demand surge with the first stimulus payments and the demand decline with the last stimulus payments appears to me to be more than coincidence.

Conclusion 4

Exports are not going to save us. And that is especially true of exports to China. Many have long expected China to come back to the U.S. for pork at some time but everything we hear out of China says they are in the same boat we are. Soft demand, plenty of pigs, the need to liquidate part of their sow herds, competition from other species – the discussion is almost identical to what we talk about for the U.S. The one caveat for this one is the large reduction of EU pork output that could open some opportunities for the U.S. Those will help but will likely not be large enough to overcome $90-plus costs.

Conclusion 5

With demand lower (but still good historically) and costs lower (but still high historically) even today’s historically good hog prices will not be enough to return us to profitability.

Conclusion 6:

There is one well-known outcome that has characterized past situations that mirror our current scenario; the marketplace will force a reduction in pig supplies. The lowest-cost producers, those that can command sufficient hog prices and those that make the wisest risk management decisions may be able to maintain sufficient financial condition to continue and others may not.

This message brings me no joy at all and I hope I am wrong on some or all of these conclusions. My job, though, is to inform you, the reader, of my thoughts on market conditions. I will sleep tonight believing I have done so.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Meyer via email.

About the Author(s)

You May Also Like