Agriculture continues to adapt to changing demands from the global economy producing food, fiber, feed and fuel with the biggest shift driven by the research and development of renewable sources of energy

April 15, 2010

Agriculture continues to adapt to changing demands from the global economy — producing food, fiber, feed and fuel — with the biggest shift driven by the research and development of renewable sources of energy.

Worldwide, biofuel production has increased dramatically in recent years. The United States and Brazil have led the charge, but many other countries have begun exploring the potential of their agricultural production for energy conversion.

This adaptation put stress on agricultural markets. Existing uses of crops, such as for livestock feed, have faced significant adjustments with the shift towards biofuels. This is but one of the challenges the pork industry faces.

Short-Term Feed Challenges

In the near term (spring, summer), ethanol demand, corn quality and soybean exports will shape the feed market.

While corn demand by ethanol manufacturers has continued to grow over time, there have been some major swings in that market. Before the recession hit, the ethanol industry grew significantly, becoming a major force in corn markets. But, through the latter half of 2008 and the first half of 2009, the ethanol industry struggled as fuel margins shrank and overall fuel demand fell. The industry continued to grow during this period, but the growth rate slowed dramatically. Several ethanol plants shut down operations.

But the prospects for the ethanol industry have improved over the last nine months. Margins have improved with slightly higher ethanol prices and relatively stable corn prices. Many plants returned to production, and ethanol's demand for corn looks fairly strong once again.

Ethanol used roughly 3.7 billion bushels (30%) of the 2008 corn crop. Projections are that 4.3 billion bushels (33%) of the 2009 corn crop will go to ethanol, and that number is expected to increase for the 2010 crop.

Although the 2009 corn and soybean crops were the largest in U.S. history, grain quality issues arose. Hail damage in several areas of the Corn Belt, combined with delayed maturity and a slightly earlier-than-normal freeze, led to quality concerns. Delayed maturity yielded lower corn test weights, which could impact feed efficiency — although the academic literature is divided on that. Hail damage made some corn more susceptible to mold, and high moisture at harvest created other crop quality issues.

The condensed harvest period last fall meant some corn and soybean crops were stored at less than ideal moisture levels. This shortens how long crops can be stored before quality starts to slip. Good quality corn and soybeans may be harder to find through the summer.

Soybean meal supplies have fallen over the past couple of years and prices have risen accordingly. Demand for soybeans over the last two years and for soybean meal this year has been strong from export markets. The near-term outlook for soybean meal shows more supplies heading out-of-country, with a continuing drop in domestic demand. But prices are projected to come down from the recent highs.

A buildup in U.S. wheat stocks is another factor in the feed market. With projected 2009/2010 wheat ending stocks over 1 billion bushels, there is a lot of wheat hanging over the market. Some will work into feed rations and compete with corn.

Long-Term Feed Challenges

Competition with biofuels for feedstocks will continue, long-term. The long-term outlook for oil prices has many countries exploring renewable energy sources. Biofuels, specifically ethanol, were the first targets of this exploration because the technology had already been developed and some production plants already existed.

Political and social instability in several of the major oil-producing regions of the world affects the oil price outlook. And there are concerns about the human impact on the global climate.

Given the energy demand for transportation and the release of greenhouse gases through petroleum fuels, reform of the transportation sector and development of alternative transportation fuels is a high priority for many countries. The United States has established a goal of 36 billion gallons of renewable fuel by 2022, with 15 billion of that coming from conventional sources, such as corn-grain ethanol.

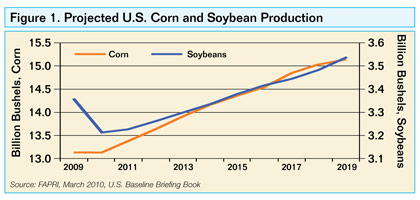

Long-run projections from the Food and Agricultural Policy Research Institute (FAPRI) show U.S. corn prices holding around $4/bu. Figure 1 shows corn and soybean production projections over the next decade. Both crops are expected to meet growing demands.

Figure 2 shows corn demand for ethanol is projected to exceed corn feed demand by 2015. But a growing percentage of feed demand is expected to be filled by distillers' grains, the main co-product from the ethanol production process. Demand for distillers' grains is projected to increase by 39% over the next 10 years.

Projections for soybean meal show supplies and demand growing at roughly the same pace. Long-term prices are projected at about $280/ton. Larger distillers' grains stocks are expected to limit upward price potential for soybean meal.

Biofuels will also play a role in the soybean oil market. The FAPRI projections have biodiesel demand for soybean oil rebounding, long-term, in part relying on the return of the biodiesel tax credit. This would support more domestic crushing of soybeans and contribute to higher soybean meal supplies in the future.

Crops Impact on Hog Profits

The strength in crop prices over the last two years, linked with the surge in biofuel production, has contributed to the substantial equity losses seen in the hog industry recently. However, there are reasons to believe the pendulum is swinging back towards profitability.

The general economy, domestically and internationally, seems to be on the mend. While pork exports are not expected to rebound to 2008 levels, the outlook is for pork exports to resume the upward trend seen in the early 2000s.

The feed price outlook has prices holding near today's levels. And the recent reductions in pork production point to higher pork prices. The FAPRI projections (Figure 3) show positive net returns to the pork industry over the next few years, but the cyclical pattern in hog returns will continue as we look further out.

You May Also Like