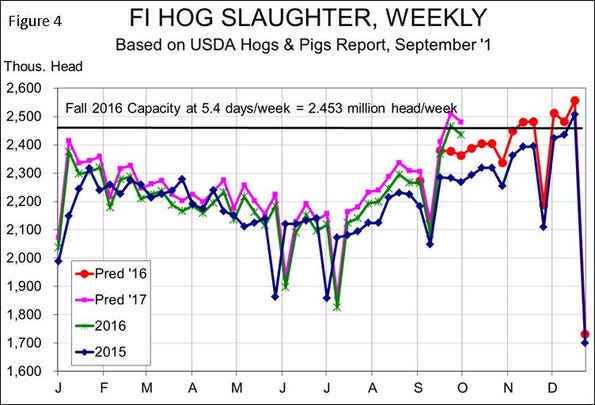

So what should you make of this report? It means trouble. My long-standing, often shrill warning about packing capacity is coming true. Fourth quarter slaughter will run at capacity from early November onward and will be above capacity for several weeks in December.

October 4, 2016

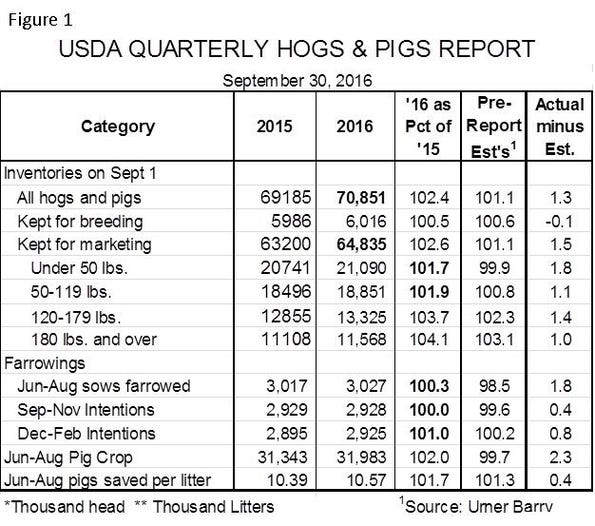

You have likely read by now the details of USDA’s September Hogs and Pigs. For reference, I provide the details in Figure 1. The report was viewed as somewhat bearish when it was released since most every market inventory category or measurement was larger than was expected, on average, by the analysts surveyed before the report.

CME Lean Hogs futures were kinder than expected today with October posting a small loss, December posting a small gain and every other contract increasing sharply. Contracts from May through October 2017 all gained more than $3 per hundredweight, erasing all of last week’s pre-report losses.

I’m not sure what generated all of the optimism. I think it may have been more sympathy after the bludgeoning of the past few weeks.

Some takeaways from the report are:

♦ The breeding herd is still growing and USDA’s estimate is, to me, more reasonable than those of the past two quarters. Lower sow slaughter this summer suggested some growth was occurring. Anecdotal evidence from equipment and breeding stock suppliers suggests that robust growth is occurring. Friday’s figure of 6.016 million was 0.6% larger than one year ago and puts us back on track to hit 1% annual herd growth (6.06 million head) by Dec. 1.

♦ Both the all-hogs and pigs and breeding herd inventories were record large on Sept. 1. That marks the fourth straight report in which market hog inventories set a new record for the respective quarter.

♦ All of the weight categories were larger than pre-report estimates by 1% or more. Most concerning, the 180-and-over category increase (4.1%) was, though very large, much smaller than the 6.9% actual increase in September slaughter. The lateness of this report (Sept. 30) takes out most of the guesswork about this number for the month and, if anything, it is low since we are importing fewer Canadian market hogs this year.

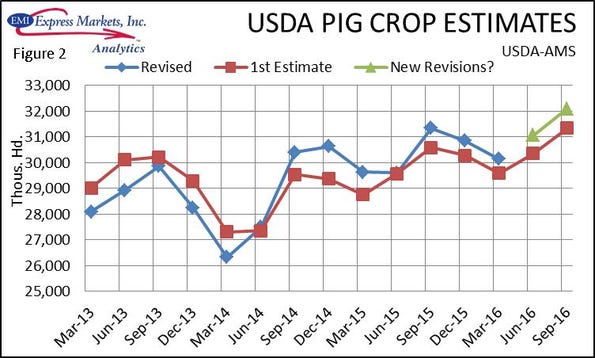

♦ UDSA farrowings and litter size estimates appear to me to be more reasonable than those of the past few quarters. But the estimators once again revised the six-month-past pig crop upward and accounted for 100% of the change by revising farrowings upward. They apparently never miss the litter size! More on that later. Figure 2 shows the pattern of revisions, the last of which (blue line) was for the December-February crop that was first published in the March 2016 report. Only once in the last seven quarters has USDA not significantly revised the pig crop upward and the average over that time period has been 2.45%. The green observations represent where the March-May and June-August crops will fall should they be revised in a similar manner. This is getting to look like systematic error in estimating the pig crop.

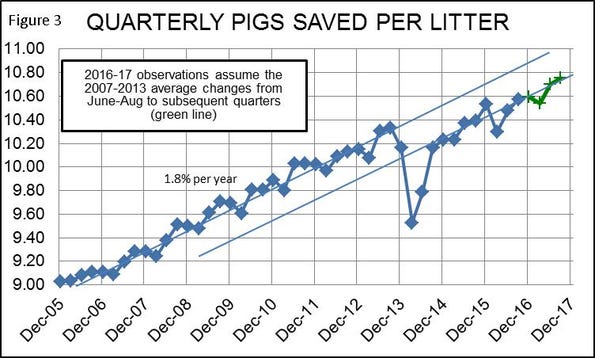

♦ We believe USDA will either adjust their estimates upward in the future or continue revising pig crops higher. The reason is that recent average for pigs saved per litter are likely too low. See Figure 3. Since porcine epidemic diarrhea virus, litter sizes have been trending higher but why have did they not return to pre-PEDV levels when the disease itself began taking only a fraction of the pigs it did in 2013-14? The genetics and management of these herds is the same as before PEDV. Breeding companies didn’t suspend their efforts to make genetic progress. I’m not aware of any high-value, highly prolific nucleus herds being lost. So why is this breeding herd not capable of moving back to the actual trend it was on before PEDV and not just resuming the uptrend but from a lower level? I understand fully that we are back on the same improvement trend but why did we not go back to where we were? I think it explains USDA’s failures in predicting recent pig crops.

So what should you make of this report? It means trouble. My long-standing, often shrill warning about packing capacity is coming true. Fourth quarter slaughter will run at capacity from early November onward and will be above capacity for several weeks in December. The surge of slaughter the past two weeks is driven in part by a few hogs moving early since weights have been constant instead of rising as they normally do in late-September. But the surge is, for the most part, a harbinger of what is to come.

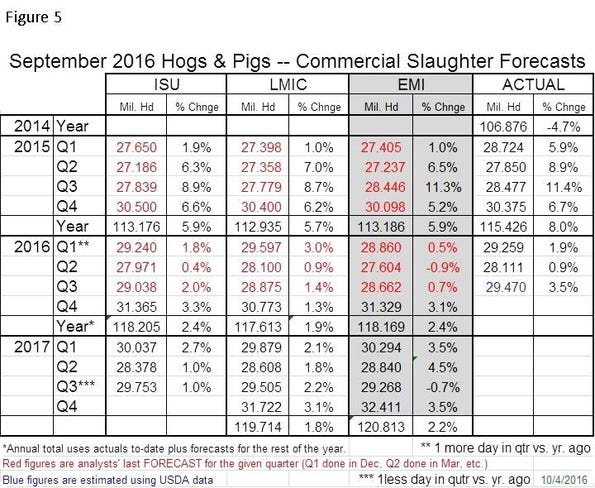

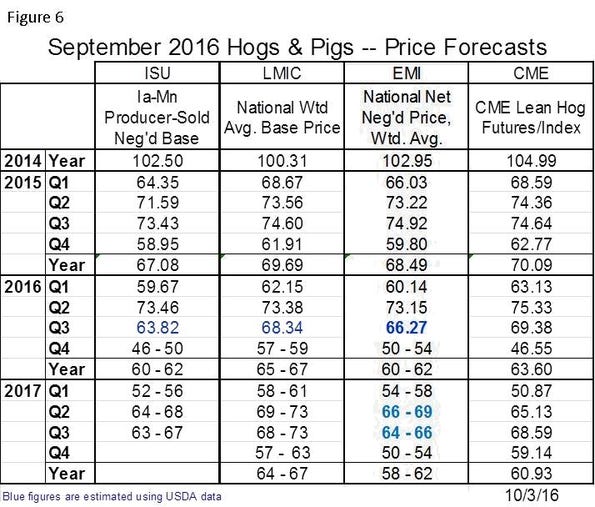

My compilation of analysts’ forecasts, including mine, appears in Figures 5 and 6. The slaughter numbers are astonishingly large and continue so into 2017 as it appears none of us think the breeding herd is going to stop growing this year.

The prices are equally astonishing to the low side, but I will warn you that this fall could be worse than you see here. We are in a situation where supply will be right against packing capacity. That will leave both hog supply and demand the same and fixed in terms of quantity — the packers won’t be able to take any more hogs and producers won’t be able to ship any fewer. The result of that is what we economists call an “indeterminate price” — it could be anything from zero up to, perhaps, last year’s price level.

I hope I am wrong but this smells a lot like 1998, and the fallout was not pretty. Besides a major reduction in the number of hog producers, $8 hogs got us mandatory price reporting which, even though I believe it has turned out okay, was hugely expensive for both government and packers; and anything that pushes packer costs higher eventually hurts producers or consumers. Packer margins are already near the level of 1998 so it is hard to believe that the spread between hog and pork prices and the value of byproducts together are not large enough already to make this year another banner one. Packers clearly cannot talk to one another or collude or manipulate prices in any way — even if their action is for the good of producers. But they can each make their own decisions about the value of their suppliers — now and in the future. There is no law against that as long as their actions are independent.

I am no fan of government intervention, but I can almost guarantee you this: If anything close to ’98 happens again, there are lawmakers waiting to change the system — even if the change is clearly for the worst to most logical industry participants.

About the Author(s)

You May Also Like