What would help U.S. trade the most now would be a dollar valued at 2011 levels rather than 2015 levels.

Raising hogs was much less profitable in 2015 than in 2014. Calculations by Lee Schulz at Iowa State University estimate the average profit per hog marketed in 2015 at $7.93 per head, down $53.92 from the record set in 2014. The primary reason for the decline in profits was a 33% drop in hog prices driven by an 8% increase in 2015 hog slaughter. A contributing factor was that last year was a disappointing one for international pork trade.

U.S. pork imports were up 10.3% in 2015 with three quarters of the increase coming from Canada. Pork imports equaled 4.5% of U.S. pork production last year, the highest share for any year since 2006.

Although up 1.7% in tonnage compared to the year before, U.S. pork exports in 2015 increased far less than pork production. Pork exports during 2015 equaled only 20.2% of U.S. pork production. That was the lowest share since 2010.

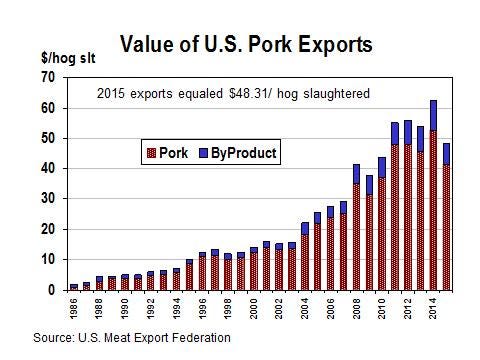

According to the U.S. Meat Export Federation, U.S. exports of pork and pork variety meats during 2015 totaled $5.6 billion in value. That was down $1.1 billion (16.5%) from the year before and the lowest annual total since 2010. The sharp drop off in the value of pork exports was because of the decline in pork cutout value. Pork cutout was down 28% from 2014.

Given 2015 commercial hog slaughter of 115.4 million head, the total value of pork exports equaled $48.31 per hog slaughtered, the lowest value since 2010. The year-to-year decline in the value of exports equaled $9.52 per hog slaughtered last year and was the biggest yearly decline ever.

2015 growth markets for U.S. pork

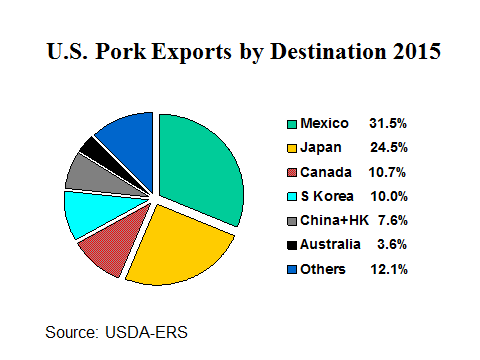

The two big growth markets for U.S. pork exports last year were Mexico and South Korea. Pork shipments to Mexico were up by 176.3 million pounds compared to 2014 and exports to South Korea increased by 107.9 million pounds.

On the basis of money spent, Japan has been the number one buyer of U.S. pork for more than 30 years. On a tonnage basis, Mexico has been the top foreign buyer of U.S. pork each of the last two years.

The two major markets in which he U.S. pork lost ground last year were Russia, down 101.6 million pounds, and China, down 77.7 million pounds. Shipments to Russia were basically zero because of a trade ban arising from a political dispute over the war in Ukraine.

The strong U.S. dollar was also a factor. Compared to other major currencies, the dollar was 16.2% more costly in 2015 than in 2014. The dollar was up 19.9% against the Euro, up 14.5% against the Japanese Yen, up 41.9% against the Brazilian Real, up 15.8% against the Canadian dollar, and up 19.3% verses the Mexican Peso. The greater the cost of buying a dollar with foreign currency, the more difficult it is for U.S. producers to make export sales.

Trade fundamentals improving

The outlook is brighter for improved trade in 2016. Pork trade ended 2015 on an encouraging note. U.S. pork exports were up 9.1% in December and U.S. pork imports were down 0.6% from a year ago.

The dollar is showing signs of weakness. In early February it was at the lowest level in three months against major currencies.

USDA is predicting U.S. pork export tonnage will increase 3.7% in 2016 and imports will decrease 10% compared to last year. That combination should lower the amount of pork on the domestic market by a bit over 1% compared to last year’s trade situation.

Canada is the largest foreign supplier of pork to the U.S. A decline in pork imports from Canada may be offset by an increase in imports of hogs from Canada. In December pork imports from Canada were down 8.4%, but imports of hogs from Canada were up 24%. In 2015, the U.S. imported 5,741,056 hogs; all of them came south from Canada. Last year U.S. hog imports were 16% more than in 2014, and the most for any year since 2011.

Domestic demand for pork usually goes up and down with the overall economy. Measured at the grocery store level, U.S. pork demand was up 5.9% in 2014. Export demand also was up 5.9% in 2014. For 2015, domestic demand was up 4.2%, but export demand for U.S. pork was down 11.8%. This combination translated into 2% lower packer demand for hogs in 2015.

A lot of factors can change international pork trade: disease outbreaks, changes in hog inventories, diplomatic disputes that spillover into trade retaliation, economic growth and recessions, etc. What would help U.S. trade the most now would be a dollar valued at 2011 levels rather than 2015 levels.

About the Author(s)

You May Also Like