August 26, 2013

We regularly talk to our clients about understanding costs and managing risk in order to be ready when opportunity knocks. With margins for hog producers above the 90th percentile many times, and approaching historical levels for some time periods, opportunities over the past six weeks and looking ahead to the next 12 months are phenomenal.

In speaking with multiple risk management firms, I’ve learned their clients are buying more coverage than ever before. No doubt this is in part due to the near-historical level of forward margins. But it’s also obvious that many producers are taking advantage of strong returns when they present themselves. In looking at AgStar's portfolio today it's not uncommon to see 75%-plus coverage for all of the next 12 months. With this much coverage, it makes one wonder how long it would take to see contraction in a major downturn.

These great margin opportunities have not only presented themselves because of the large crop carryouts projected going into next year, but also because of the continued strength in hog prices. Recent USDA projections peg total pork slaughter year-to-date fairly close to last year and although there has been some expansion in the past year, porcine epidemic diarrhea (PED) virus has many expecting no increase in numbers and maybe even a decrease in certain time frames. On top of this, domestic demand and certain export markets have helped offset export losses in the Chinese and Russian markets.

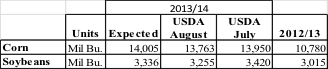

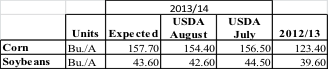

In looking at the most recent World Agricultural Supply and Demand Estimates (WASDE) report, from Aug. 12, there were some surprises that have helped pressure margins lower for the past week. Both corn and bean estimated yields came in below expectations with corn at 154.4 bushels/acre and soybeans at 42.6 bushels/acre. See the table below for a breakdown of the numbers. These lower numbers have spurred the corn and meal markets higher and pulled average margins down to roughly $16 per head vs. the high of around $21 per head prior to the report. Even with the lower yield expectations, the carryout still remains higher than we've seen for years, which should help keep a lid on corn prices. It appears that for now we may have hit bottom on corn and bean meal, however, it will be interesting to see how harvest progresses and what basis will look like this fall.

USDA Production #'s:

Source: USDA National Agricultural Statistics Service

Yield:

Source: USDA National Agricultural Statistics Service

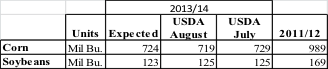

2012-2013 Ending Stocks:

Source: USDA National Agricultural Statistics Service

2013-2014 Ending Stocks:

Source: USDA National Agricultural Statistics Service

At the end of the day, the next 12-18 months are projected to bring strong margins and producers are taking advantage. The number of producer positions in place today shouldn't surprise us given the positive outlook. It seems like margin opportunities like this don't last long and the question for those waiting for a better opportunity is how much more does one need?

You May Also Like