Combined red meat and poultry consumption is expected to increase by 3.6 pounds per person this year and to be up another 2.5 pounds more in 2017.

Each month, the USDA publishes their predictions for the major farm commodities in a publication called World Agricultural Supply and Demand Estimates. WASDE’s first look ahead to 2017 predicts more meat, more feed and lower prices.

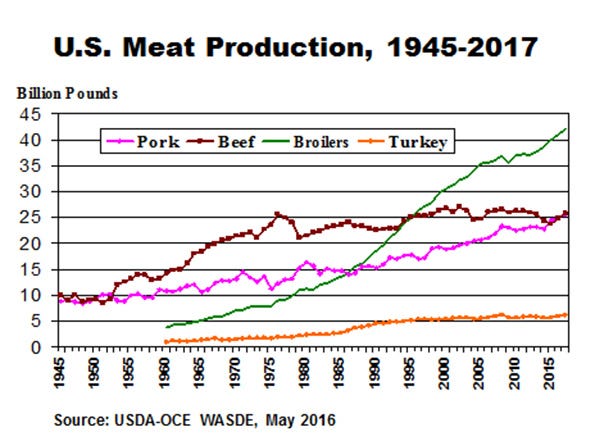

As corn supplies have grown over the last three years, U.S. meat production has gone up. Total red meat and poultry production was up 2.6% in 2015, and is forecast to be up 3.1% this year and up another 2.9% in 2017. In addition to more pork, there is more beef, more chicken and more turkey expected in the coming year.

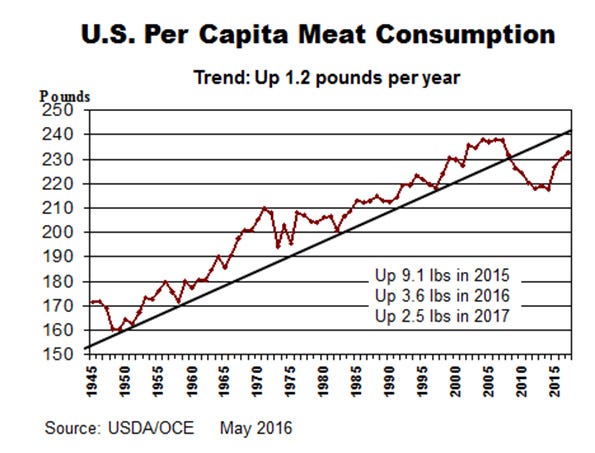

Over the last 60 years, per-capita meat consumption has increased at an average rate of 1.2 pounds per year. Americans ate an average of 160.6 pounds of red meat, poultry and fish in 1949 and 231.8 pounds in 2008. Both meat production and consumption declined in 2007-12 as feed prices increased dramatically. Combined red meat and poultry consumption is expected to increase by 3.6 pounds per person this year and to be up another 2.5 pounds more in 2017.

Over the last 60 years, per-capita meat consumption has increased at an average rate of 1.2 pounds per year. Americans ate an average of 160.6 pounds of red meat, poultry and fish in 1949 and 231.8 pounds in 2008. Both meat production and consumption declined in 2007-12 as feed prices increased dramatically. Combined red meat and poultry consumption is expected to increase by 3.6 pounds per person this year and to be up another 2.5 pounds more in 2017. USDA expects 2016 pork production to be 2.0% more than last year’s record of 24.5 billion pounds. They are predicting another 2.6% increase in pork production in 2017. This is faster growth than the 1.5% long-term trend and is likely due to declining feed prices, profits in the hog business and expanding packer capacity. Two large new hog slaughter plants are currently under construction and will open in 2017.

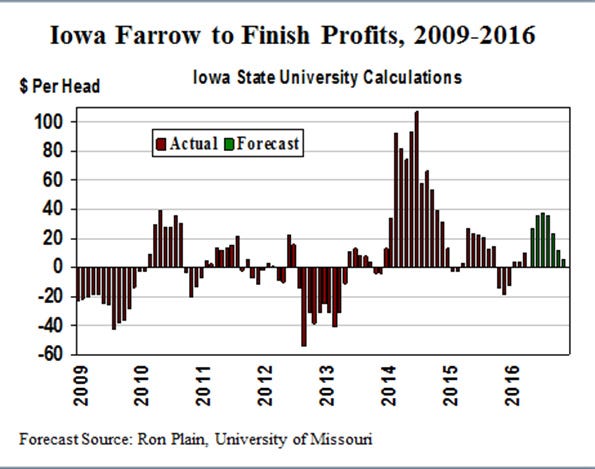

USDA expects 2016 pork production to be 2.0% more than last year’s record of 24.5 billion pounds. They are predicting another 2.6% increase in pork production in 2017. This is faster growth than the 1.5% long-term trend and is likely due to declining feed prices, profits in the hog business and expanding packer capacity. Two large new hog slaughter plants are currently under construction and will open in 2017.

Fast growth in pork production means that per capita consumption is rising. The retail weight equivalent of pork consumption is forecast to increase from 49.8 pounds in 2015 to 50.1 pounds this year to 51.0 pounds next year.

U.S. pork imports and pork exports were both slightly higher in 2015 and both are expected to increase further this year and next. Meat exports have been slowed in recent years by the strength of the dollar. The value of the dollar against major foreign currencies was 25% higher at the start of 2016 than it was four years ago. The value of the dollar has been declining in recent months and that is good news for exports.

Hog prices averaged about $50.23 per hundredweight of live weight in 2015. USDA expects live hog prices to average roughly $3 per hundredweight lower this year than last. They foresee another $3 per hundredweight decline in 2017.

The futures market is more optimistic on prices. Futures prices imply 2016 and 2017 hog prices will average close to last year’s level.

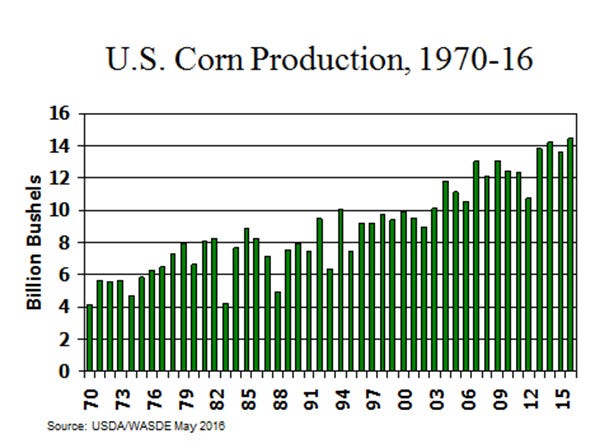

Big corn crop expected

USDA is predicting this fall’s corn harvest will be the largest on record thanks to the third highest per-acre yield ever and the most corn acres planted since 2013. That combination produces the nation’s second 14 billion bushel corn crop and 1.5% more corn than the 2014 record harvest. Of course, this summer’s weather will have the final say on this matter. The three largest corn crops came in the last three years. Add in a record crop this fall and carryover stocks become very large. USDA sees ending stocks growing to 2.153 billion bushels on Sept. 1, 2017, the most since 1988.

The three largest corn crops came in the last three years. Add in a record crop this fall and carryover stocks become very large. USDA sees ending stocks growing to 2.153 billion bushels on Sept. 1, 2017, the most since 1988.

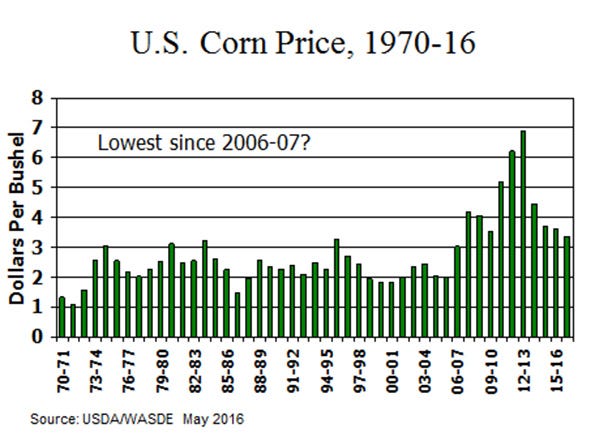

Low corn price expected

USDA is forecasting the average corn price for the 2016-17 marketing year at $3.35 per bushel plus or minus 30 cents. If correct, that will be the lowest annual average price since the 2006 crop. The futures market is more bullish on corn prices than is USDA. Current futures contract prices point to corn prices 40 cents per bushel higher than USDA’s forecast. The lowest corn prices in a decade may produce the lowest cost of gain for hog farms in a decade. Iowa State University calculations put the breakeven live price for slaughter hogs between $45 per hundredweight and $49 per hundredweight during the last 12 months. If summer weather is close to normal, then hog cost of production should remain in the mid- to upper-$40s on a live weight basis during the coming 12 months.

The lowest corn prices in a decade may produce the lowest cost of gain for hog farms in a decade. Iowa State University calculations put the breakeven live price for slaughter hogs between $45 per hundredweight and $49 per hundredweight during the last 12 months. If summer weather is close to normal, then hog cost of production should remain in the mid- to upper-$40s on a live weight basis during the coming 12 months.

The March planting intentions survey indicated 82.2 million acres would be planted to soybeans this year, the third highest after 2014 and 2015. USDA predicts this year’s yield will be 46.7 bushels per acre, the third highest after 2015 and 2014. Total production is expected to be 3.8 billion bushels, the third largest U.S. soybean crop. Prices are expected to average somewhere between $8.35 and $9.85 per bushel. USDA expects exports to set a new record with nearly half of the crop to be exported. USDA expects soybean meal to average between $300 and $340 per ton.

If the futures market is correct, hog profits will be a bit higher this year than last. If USDA’s price forecasts are right, profits this year may be slightly lower than in 2015. Either way, hog profits could be hard to come by in 2017 if meat production continues to increase as expected.

About the Author(s)

You May Also Like