Given the usual wide basis during harvest, corn prices should stay low enough to keep breakeven hog prices in the high $40s on a live weight basis.

This year’s corn acreage is up 7% from last year and is the third highest since 1944. The condition of the crop is comparable to last year. It looks like this year’s corn harvest will exceed 14 billion bushels for only the third time in history.

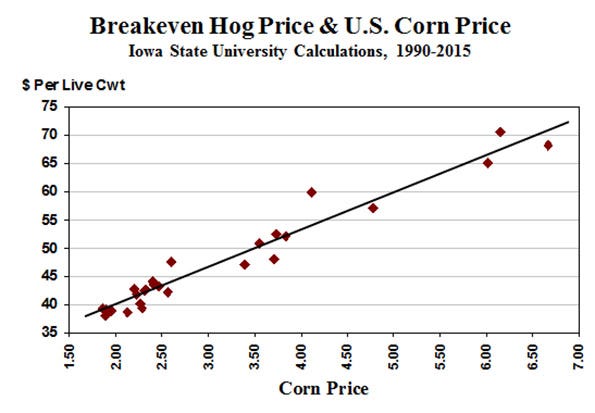

As the next chart shows, the cost of raising hogs is closely tied to corn prices. Corn is typically about one-third of the cost of raising hogs. The futures market expects corn prices to stay in the $3.50 to $3.75 per bushel range during the next 12 months. Given the usual wide basis during harvest, corn prices should stay low enough to keep breakeven hog prices in the high $40s on a live weight basis. As corn prices backed down from the $5 to $7 per bushel levels of 2011-13, livestock and poultry production increased. Red meat and poultry production is expected to be up 3.3% this year and up 2.5% next year. Since population growth is less than 1% per year, per capita meat consumption is increasing.

As corn prices backed down from the $5 to $7 per bushel levels of 2011-13, livestock and poultry production increased. Red meat and poultry production is expected to be up 3.3% this year and up 2.5% next year. Since population growth is less than 1% per year, per capita meat consumption is increasing.

U.S. meat consumption is still below the levels of earlier this century when corn was $2 per bushel, but it is climbing. Last year, the average American consumed 226.8 pounds of red meat, poultry and seafood. This year, per capita meat consumption is expected to increase by 3.7 pounds. It is forecast to be up another 1.9 pounds in 2017. More meat per person is likely to mean lower meat prices per pound. Much of the growth in U.S. pork production during the last 25 years has gone to foreign markets. U.S. pork exports peaked at 5.4 billion pounds in 2012 and have hovered slightly below five billion pounds each year since.

Much of the growth in U.S. pork production during the last 25 years has gone to foreign markets. U.S. pork exports peaked at 5.4 billion pounds in 2012 and have hovered slightly below five billion pounds each year since.

The plateau in pork exports has two main causes. A strong dollar has made U.S. products expensive relative to foreign competition. The porcine epidemic diarrhea virus outbreak in 2013 reduced U.S. pork supplies.

Thanks to record high pork prices in China, U.S. pork exports are expected to exceed five billion pounds this year and next. Shipments to China and Hong Kong in May were the most for any month since January 2012. Although the Chinese government is committed to being self-sufficient in pork, they have shown a willingness to import large quantities of pork when their domestic supplies fall short.

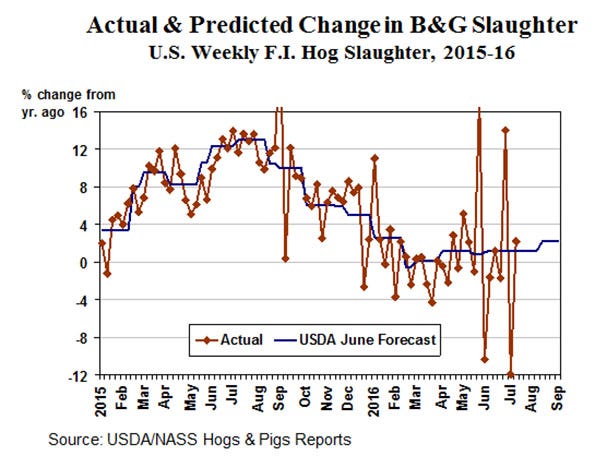

Hog slaughter was up 8% in 2015 as the herd recovered from PED. The increase is much less this year. The June USDA hog inventory survey says market hog numbers were up 1.9% year-over-year. The market hog inventory weight groups implied barrow and gilt slaughter will be up 1.2% in June-August and up 2.4% in September-November. This year hog weights have been running below the year-ago level, so the increase in pork production is slightly less than the increase in hog slaughter.

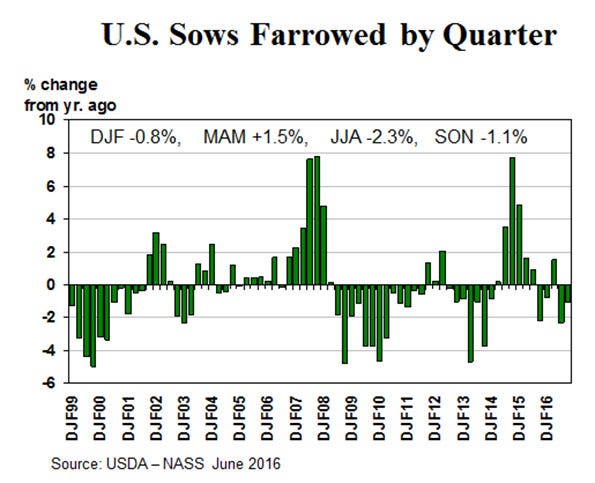

The number of sows farrowed during March-May was up 1.5%. Farrowing intentions for June-August are down 2.3% and for September-November down 1.1% compared to the same months in 2015. The low farrowing intentions are encouraging and a bit surprising.

Hog production has been profitable the last few years, and profits usually bring an increase in litters farrowed. Revisions are possible and an increase in farrowings may yet occur. The March hogs and pigs report says March-May farrowing intentions were down 0.5% compared to a year ago. The June report says spring farrowings were actually up 1.5%.

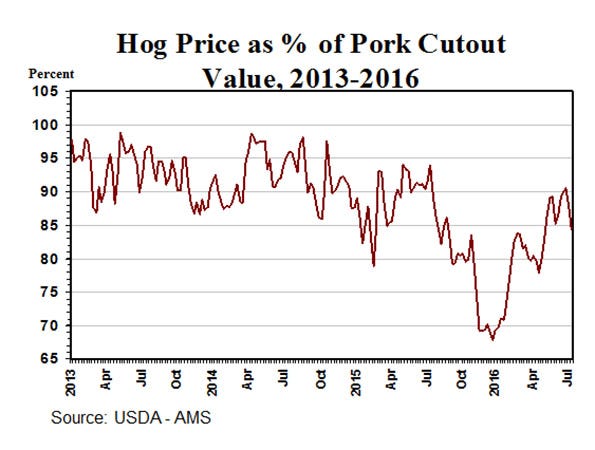

Hog packers are having a good year. This year’s hog slaughter is likely to break the 2008 record. Lots of hogs and limited slaughter capacity are holding hog prices down relative to wholesale pork prices. The base carcass price for hogs historically has averaged around 92% of the pork cutout value. The ratio is usually lowest during the fourth quarter and highest in the summer.

At times last December, hog prices dropped to 70% of the cutout value. That could happen again late this year. More slaughter plants are coming on line and that should boost 2017 hog prices relative to cutout value.

About the Author(s)

You May Also Like