November 16, 2015

He who lives by the belly dies by the belly. No, that is not a health warning from my doctor; it is an appropriate summary of recent pork and hog markets, I think. Let’s explore.

The pork and hog price debacle entered its fourth week today as the front three Lean Hog futures contracts lost another $3 per hundredweight with December closing at a new six-year low of $51.80. My calculations of pork producer margins now show losses of more than $30 per head for average farrow-to-finish operations in November and December, an average loss of $2.57 per head for this year and, more important, projected losses of $6.40 per head for 2016. It wasn’t too many weeks ago that the 2016 figure was plus-$10 per head.

What went wrong?

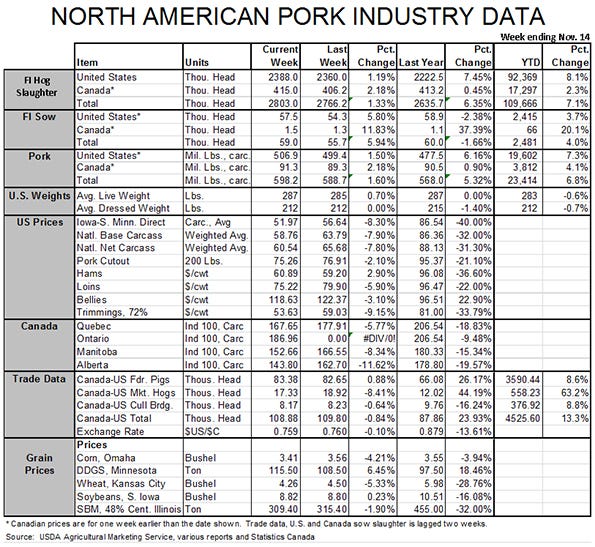

First, supplies are large but they are in no way surprisingly large. Estimated pork production for last week was indeed record-high at 506.9 million pounds, carcass weight. That is the fourth week ever above 500 million, and breaks the previous record set in December 2007 when the initial wave of pigs saved by circovirus vaccines was hitting U.S. packing plants.

Numbers don't add up

But record production does not mean we are swamping the U.S. market with pork. The U.S. population is about 15 million (5%) more now than it was in December 2007. That fall we were exporting between 300 million and 340 million pounds of pork per month. September exports were just over 400 million pounds and, with supplies higher and prices lower, I would expect that figure to grow for October and November. So, per capita availability is not as large as it was in 2007.

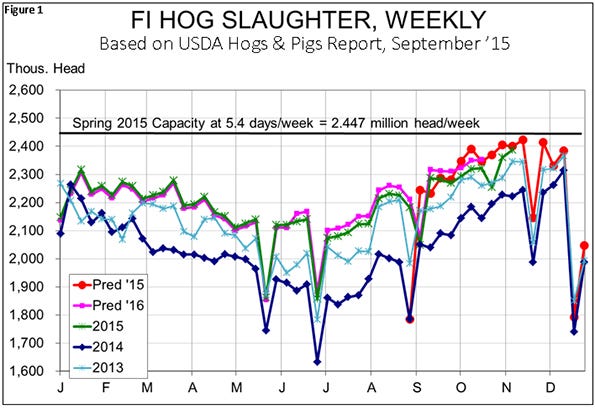

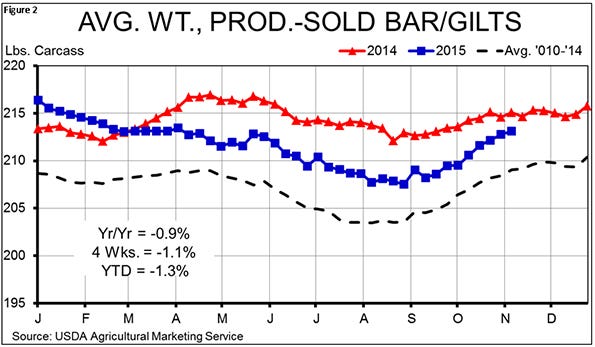

It is not even as large as I had expected over the past few weeks. Since Sept. 1, actual FI slaughter is 99.7% of the level I predicted based on the September Hogs and Pigs report inventory of market hogs. As can be seen in Figure 1 however, FI slaughter totals ran well below (2.7%) my forecast levels for five weeks. In one of those, the J.H. Routh plant in Ohio was closed most of the week due to problems with their stunning system. They got back to within 0.5% of the predicted levels last week but none of this spells “supply shock”. The same is true of weights. Yes, they have increased at a slightly higher-than-normal seasonal pace (see Figure 2) but they remain well within the range of expectations. The one concern is the combination of lower slaughter for several weeks and faster-increasing weights. Does that mean we have backed up a few pigs? If so, it’s time to move them! The pork industry doesn’t need its own version of “too many monster-large animals” such as the beef industry is dealing with now.

The same is true of weights. Yes, they have increased at a slightly higher-than-normal seasonal pace (see Figure 2) but they remain well within the range of expectations. The one concern is the combination of lower slaughter for several weeks and faster-increasing weights. Does that mean we have backed up a few pigs? If so, it’s time to move them! The pork industry doesn’t need its own version of “too many monster-large animals” such as the beef industry is dealing with now.

Then, there's demand

The second issue is, of course, demand. We don’t have any data on current retail prices or product movement from which to conclude much yet. The sharp decline of the cutout value may be indicative of softening wholesale demand but the main contributor to the cutout decline has been bellies whose $45 break in primal value accounts for $7 of the $13 cutout value loss the past four weeks. Further, it is a pretty easy argument that bellies, at $30 or so over their five-year average, were too pricey given that most other cuts were near or below those same historic levels. Finally, the belly primal value had stayed within $10 per hundredweight of its normal summer peak when it normally declines by $35 per hundredweight from mid-July to mid-November. It appears to me that a big drop was pretty much inevitable.

These are obviously not good developments for producers who did not price fourth quarter hogs. But is this cause for significant concerns about 2016? I do not think so, especially relative to current futures price levels. If the September report is correct (and there has been nothing to date to suggest that it is not), 2016 supplies through the first half of the year will look very much like this year.

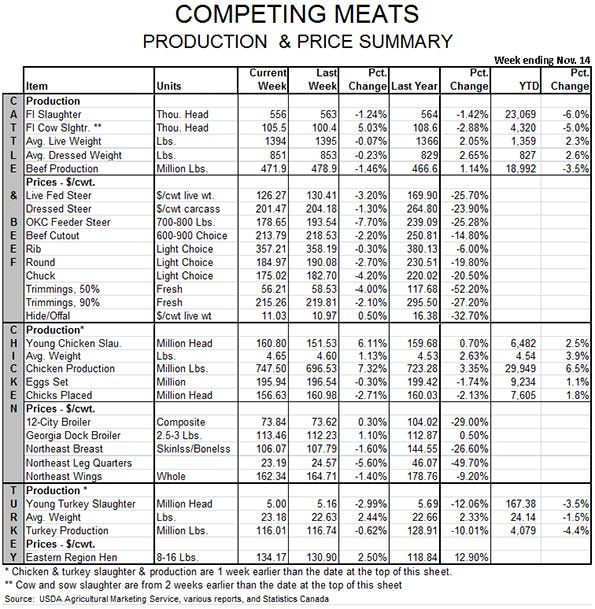

Beef and chicken will be more competitive, but I still think exports will improve some, suggesting that 2016 prices should be better than 2015 prices during the first six months since last year’s prices were impacted by the port slowdown. The third quarter should see higher slaughter and slightly lower prices, while the fourth quarter is still a big unknown and still a point of concern over slaughter capacity.

I wish I had better explanations for these fireworks but I don’t and I haven’t run into anyone who really does.

Don't blame the packers

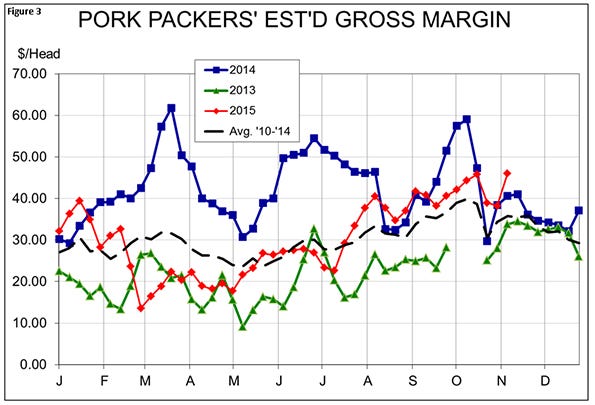

Just in case you thought it was those dastardly packers, look at Figure 3. Their margins are no doubt good, especially given the changes of last week. But are they exorbitant? That judgement is obviously in the eye of the beholder but my call would be “No, not for the fourth quarter of the year.” While the “meat spread” between the cost of the pig and the cutout value is near its highest levels except for the truly exorbitant levels of fall 1998, the value of byproducts is over $14 per head (48%) lower than it was last summer. Packer margins – and their bids for hogs – are driven by both. I would say packers are doing well enough to want to keep hogs moving through plants. That’s good for both packers and producers in the long run.

About the Author(s)

You May Also Like