Well, the primary rule of market forecasting is, “Forecast often!” It appears that the rule will come into play frequently this fall. After my effort last week to put fall supplies in what I still believe is a correct and lower context, federally-inspected (FI) slaughter exploded to 2.265 million head, 4.6% higher than the week before and nearly 7% larger than last year. The June Hogs and Pigs report indicated nothing like this in terms of market hog supplies. What’s more, the report had been very accurate (running only 0.8% below the June inventory numbers) from July 1 through August 8.

August 27, 2012

Well, the primary rule of market forecasting is, “Forecast often!” It appears that the rule will come into play frequently this fall.

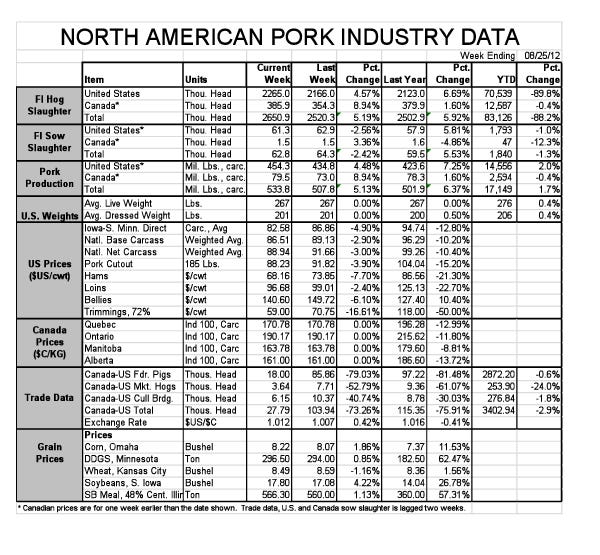

After my effort last week to put fall supplies in what I still believe is a correct and lower context, federally-inspected (FI) slaughter exploded to 2.265 million head, 4.6% higher than the week before and nearly 7% larger than last year. The June Hogs and Pigs report indicated nothing like this in terms of market hog supplies. What’s more, the report had been very accurate (running only 0.8% below the June inventory numbers) from July 1 through August 8.

How have the wheels come off? That’s a good question with at least two answers.

First, the preferable answer: Producers are pulling hogs forward. Readers know that I am usually loath to choose this explanation and I’m hesitant to choose it now. Not that I think it would be wrong to do so but just because it is so risky. If this is the reason, then lower hog numbers are coming and I hate to give anyone false hope. But there are ample reasons to get pigs moving right now and we have heard of a number of operations that are talking about reducing weights, avoiding those last few most inefficient pounds of gain and saving some feed supplies.

The hole in that argument is that weights are not, in fact, declining. But the normal seasonal impacts of thankfully-lower temperatures would be fighting producers’ efforts to reduce weights by driving pigs to eat more and grow faster. So, the relatively steady weights of the past four weeks are not, in my mind, sufficient evidence to say that producers are not moving hogs quickly.

The more troublesome argument against the “pulling-them-forward” position is the obvious fact that this summer’s heat should have slowed pigs down and backed them up in finishing buildings. And there is plenty of anecdotal evidence to support this one, too. Many barns are reported full. Packers claim they have plenty of hogs lined up for the next few weeks (that could be due to pulling forward, too, however) and there is that pesky fact of steady weights.

But this one automatically leads one to conclude that the June Hogs and Pigs report was wrong – and perhaps dramatically so. That flies in the face of recent history when the report has predicted slaughter levels relatively well.

Only time will tell, of course, but in the meantime these larger numbers are putting some severe pressure on hog prices. Daily prices approached $80/cwt carcass on Friday while the weekly average national net price fell below $90 for the first time since early June.

Part of the downward pressure was last week’s Cold Storage report which indicated that July 31 pork supplies were 20% larger than one year ago. The market seemed to ignore the fact that stocks were down nearly 8% from last month. Only three cuts – picnics, bellies and variety meats – were in lower supply this year versus last. Total meat and poultry stocks in freezers were 2.6% higher than one year ago and 2% lower than at the end of June.

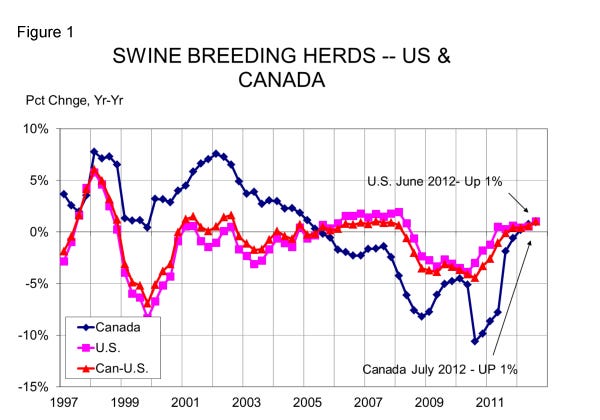

Finally, Canada’s July 1 breeding herd is estimated to be 1.216 million head, 1% larger than one year ago (see Figure 1). Canada’s market herd (called “All Other Pigs” in the Stats Canada Report) stood at 11.654 million head on July 1, 1.5% larger than last year. The total number of pigs in Canada was up 1.5% from 2011.

Canada’s Q2 pigs crop was up 1.5% from last year but producers report farrowing intentions for the next two quarters that are 1.4% and 1.3% lower, respectively, that the same two quarters last year. The nearly 3% difference between the year-on-year change in the breeding herd and farrowing intentions is very large. In fact, it is so large that I have to question one side or the other. Either the breeding herd is not that large or someone is sand-bagging the farrowing intentions. I can’t believe summer breeding performance was that much worse than in the past. With rising litter size (+1.5% in Q2), I suspect that Canada’s second-half pig crop will end up larger than one year ago.

About the Author(s)

You May Also Like