June 25, 2012

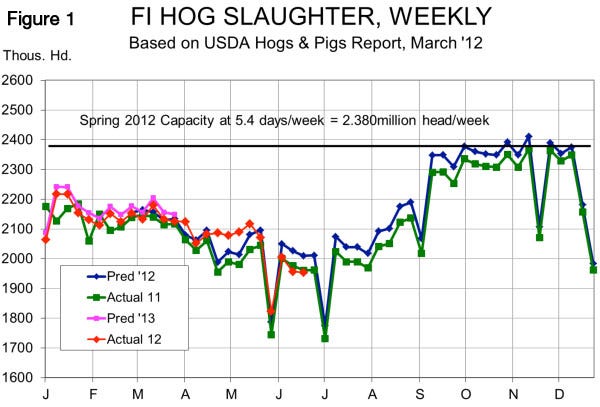

For the fourth week in the last six, federally Inspected (FI) hog slaughter was lower than the levels indicated by the USDA’s March Hogs and Pigs Report (Figure 1). Last week’s total of 1.954 million head was roughly 55,000 lower than the report indicated. That follows a week in which FI slaughter (1.957 million) was nearly 70,000 lower than expected. The report, in total, still appears to be very accurate with actual slaughter still only 0.3% higher than predicted. But the devil is in the timing as the surge of pigs in April and May is now being offset by these shortfalls vs. expectations.

For the second week in a row, FI hog slaughter was lower than last year as well. That had happened only four times this year with the last occurrence in the first week of March. This reduction in slaughter corresponds closely to the expected market dates for USDA’s 120-179-lb. inventory group in the March report. Those pigs would have been farrowed, by my calculations, in the period of mid-November through December, a time that corresponds to matings in mid-July through August. USDA, of course, said that the number of pigs in this category was 2.5% larger than one year earlier, but it is now looking like last summer’s heat and good pig performance this spring are the factors behind these shortfalls.

Cold Storage Stock Trimmed

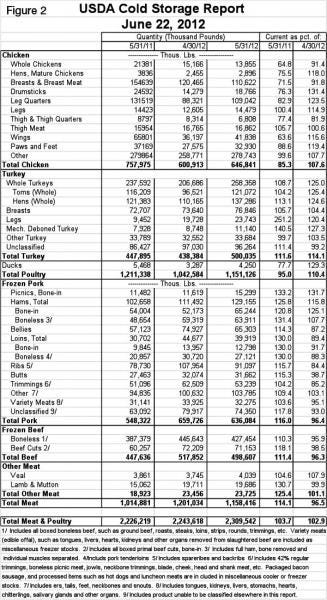

Friday’s Cold Storage report from USDA contained some more positive news as frozen pork inventories declined 3.6% during the month (Figure 2). The decline was not huge, but represented a reversal of recent higher levels of stocks. The only pork cuts in larger supply at the end of May vs. the beginning were hams (+15.8% for the month, +25.8% vs. 2011) and “other” pork (+3.1% vs. April, +9.4%, year-on-year).

The bad news is that frozen stocks of every pork cut remain larger than one year ago and the total is 16% larger. Further, the May 31 inventory of 636.084 million pounds is still the fourth-highest on record. The total represents 33% of total pork production in May, a figure that, while sharply lower than April’s 35.7%, is still at the top of the historical range.

The bottom line is this - the pork inventory situation is better, but far from good. Frozen product will weigh on some cuts and, thus, the cutout value this summer.

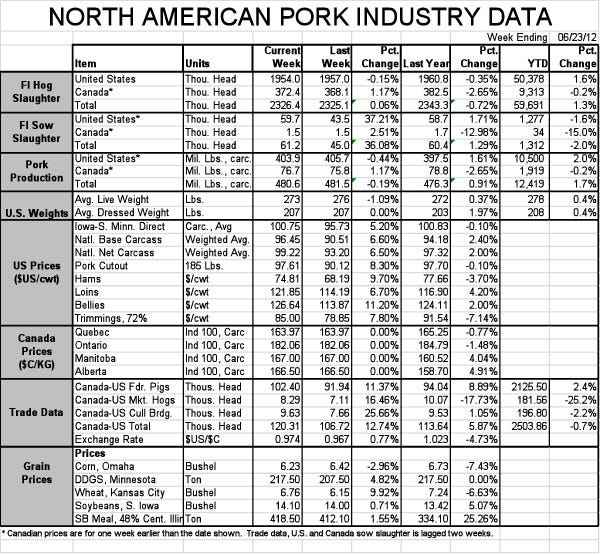

But any lid provided by freezer inventories doesn’t appear too tight at the present. USDA’s estimated cutout value for 51-52% lean hogs increased by 8.3% last week to an average of $97.61/cwt., carcass. Friday’s close was $100.81, up $2.35 from Thursday. Loins, ribs and bellies have been the big drivers of higher cutouts so far this summer. It looks like pork buyers had anticipated that the spring’s over-supply situation would continue on, providing ample opportunities to buy spot needs cheap. Lower slaughter runs have turned that situation upside down and fueled these price increases. Demand may be rebounding as well, but we have little data from which to judge that factor yet.

Packers continue to bid aggressively for hogs. Friday’s national total weighted average net price went above $100/cwt., carcass, for the first time this year, reaching $100.79/cwt., carcass. The net negotiated price hit $103.28 on Friday. Those “excellent” prices in the high $90s that many producers locked in last winter are now playing second fiddle to the spot and formula prices, but they still represent profits which were determined long ago. There is value in being able to sleep soundly.

Feeder Cattle Supplies Still Tight

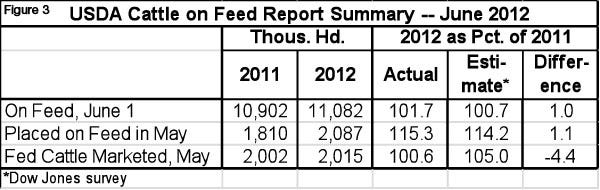

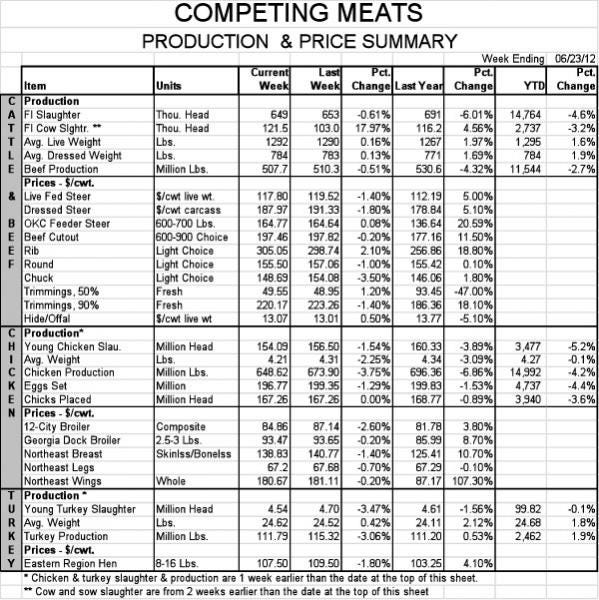

Cattle feedlot inventories returned to the “larger than last year” side of the ledger as of June 1, after just one month below year-earlier levels. Friday’s Cattle-on-Feed report (Figure 3) indicated that May placements numbered 2.087 million head, 15.3% more than one year ago. Analysts had expected placements to be sharply higher, but the actual number exceeded those expectations by 1.1%. The larger placements pushed total on-feed numbers to 11.082 million head, 1.7% larger than last year and 1% larger than analysts had, on average, expected before the report. These figures suggest that fed cattle numbers may increase in October and November, but those increases will very likely be relative to very tight supplies in August and September. Some of these May-placed cattle came from wheat graze-outs and represented animals that would otherwise have been placed in March and April.

The Cattle-on-Feed numbers are all about 2% larger due to an increase in the number of feedlots that now have capacities of 1,000 head or more and are, thus, eligible for the survey. Knock those numbers out and an apples-to-apples comparison of feedlot inventories this year and last would show this year’s being lower. Given tight feeder cattle supplies, I expect those adjusted figures to go lower yet as 2012 progresses.

About the Author(s)

You May Also Like