Lower feed prices should drop cost of hog production, but this decline is not likely to be sufficient to keep hog profits in the black. Cheap feed won’t do anything to boost hog prices, which may get very low this fall.

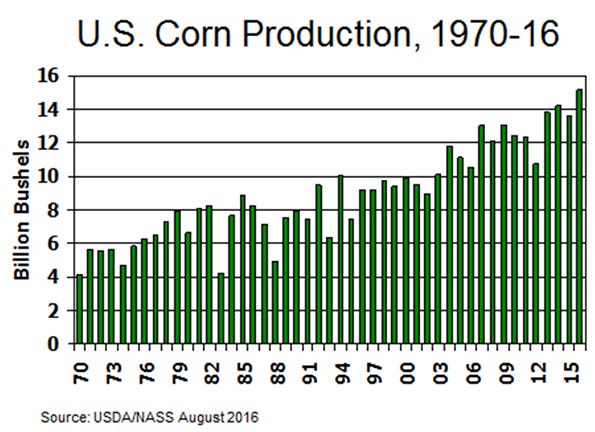

Last week’s USDA crop production report predicted this year will produce the nation’s first 15 billion bushel corn harvest and the first 4 billion bushel soybean harvest. Favorable summer weather has caused USDA to raise their yield forecast to record levels at 175.1 bushels per acre for corn, 52.6 bushels per acre for wheat and 48.9 bushels per acre for soybeans.

Corn production is predicted to be up 11.4% from last year, soybean production up 3.3% and wheat production up 13.1%, compared to 2015. This will be the third consecutive record soybean crop.

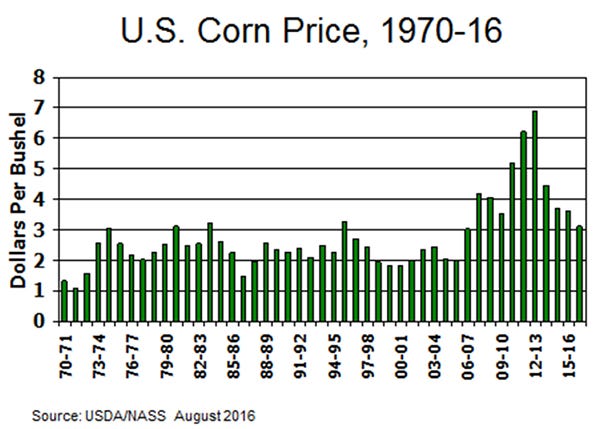

The record crop should push harvest lows for cash corn under $3 per bushel in the Midwest and bring soybean meal back down toward $300 per ton. USDA is forecasting the 2016-17 marketing year average farm level corn price at $3.10 per bushel, and predicting soybean meal will average $325 per ton. The futures market has December corn at $3.37 per bushel and soybean meal at $332 per ton.

Lower feed prices this fall and winter should drop cost of hog production to roughly $45 per hundred pounds of live weight or $60 per hundredweight of carcass. The decline in feed costs is not likely to be sufficient to keep hog profits in the black. Cheap feed won’t do anything to boost hog prices, which may get very low this fall.

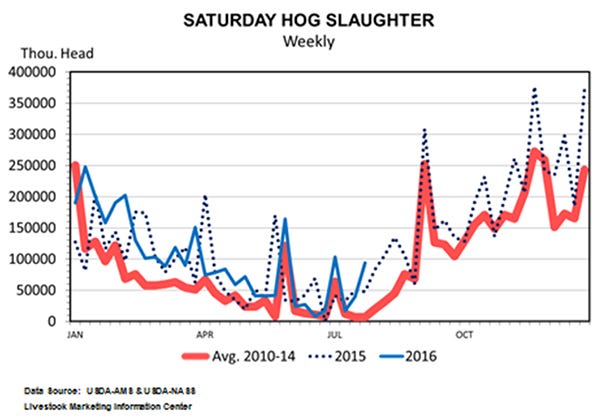

Hog prices have dropped $20 per hundredweight in the last seven weeks, driven down by increased production. Preliminary data indicate average daily hog slaughter in July was record high. Still lower hog prices are likely this fall as the supply of slaughter-ready hogs may exceed slaughter capacity.

Hog slaughter is highest during the fourth quarter; at least it has been each year since 1986. Hog packers often run plants at or close to capacity during weekdays in the fall. The increased fall hog run is handled by slaughtering more hogs on Saturdays. Slaughter capacity was tested last year.

The two biggest Saturday kills ever were Nov. 28, 2015, and Jan. 2, 2016. The hog slaughter record for a single week was 2.5 million head slaughtered during the week ending on Dec. 19, 2015. Four of the all-time top 10 slaughter weeks were in November or December of 2015.

The June hog inventory survey implied daily slaughter will be up 2.5% in October and November. Since barrows and gilts are usually slaughtered at six months of age, December slaughter will depend largely on the June pig crop. Farrowing intentions for June-August were down 2.3% in USDA’s last hog survey. Pigs per litter should be up in June-August, potentially leaving the June pig crop close to the 2015 level. If summer farrowings were higher than expected, timely slaughter late this year may be impossible to achieve for all market hogs.

There is a tendency to let marketings slide a bit as we head into fall. Feed prices are typically lower. The weather is cooler and pigs grow faster. Delaying sales in the fall is rarely a good idea. After all, hog prices usually slide lower each month. This year it may be worse than most.

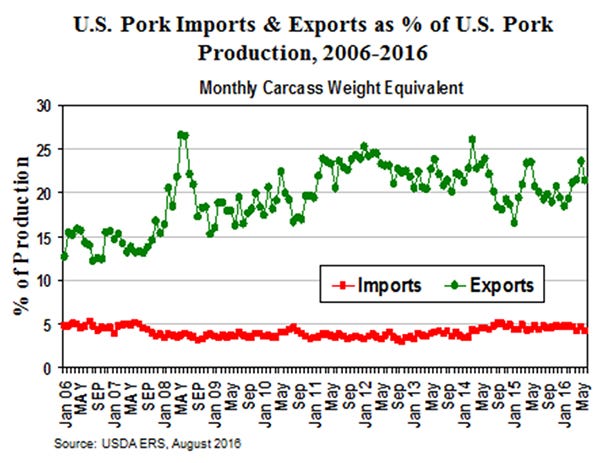

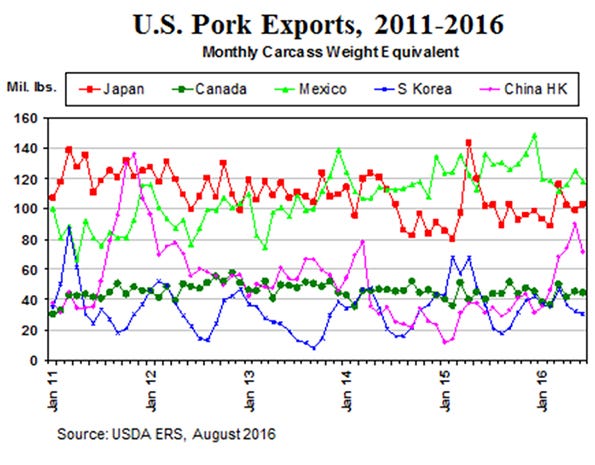

The U.S. exported 20.9% of this year’s first half pork production. Pork imports equaled 4.5% of domestic production. Both numbers are in line with recent years.

During the first half of 2016 the U.S. exported 2.54 billion pounds of pork. That was up 1.8% from the same period last year. June exports were up 4.5%. USDA predicts total exports will be up 5.6% when the year ends.

Mexico continues to be the top buyer of U.S. pork at 708 million pounds during January-June. Japan bought 602 million pounds; China 300 million pounds; Canada 255 million pounds, and South Korea 217 million pounds. Chinese pork production is down and they are importing a lot of pork, especially from Europe.

The U.S. Meat Export Federation puts the value of January-June pork exports at $2.44 billion, down 4.5% from last year. Lower pork prices this year mean that the value of pork exports is down even though tonnage is up.

Compared to the euro, the dollar buys 17.8% more than three years ago and 38% more than eight years ago. The greater the purchasing power of the dollar, the more expensive U.S. goods are for foreign customers.

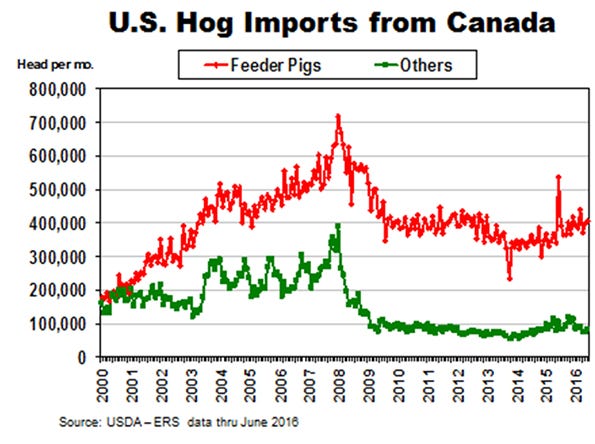

The United States imported 551 million pounds of pork during the first half of 2016. That was 8 million pounds (1.5%) more than a year earlier. Shipments from Canada were down 28 million pounds, but shipments from the European Union were up 30 million pounds. USDA predicts 2016 pork imports will be up 3.5%.

The U.S. imported 2.9 million hogs and pigs during the first half of 2016. All but 53 head came from Canada. Hog imports were up 1.1% compared to the same period last year. Of the imported swine, 60.9% were weaner pigs, 18.5% feeder pigs, 1.1% breeding stock and 19.5% slaughter hogs. The U.S. exported 19,718 hogs in January-June. That is down 20.1% (4,967 head) from last year.

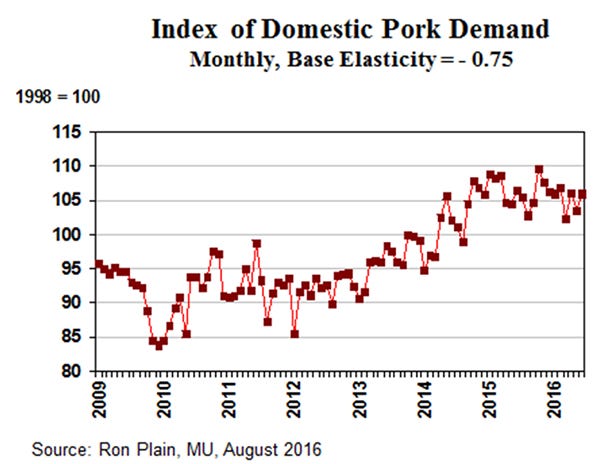

Domestic demand for red meat and poultry was down 1.2% in the first half of 2016 compared to January-June 2015. Pork demand was down 1.6%. Falling prices of competing meats and weak growth in the U.S. economy are the likely reasons for the weakness in pork demand.

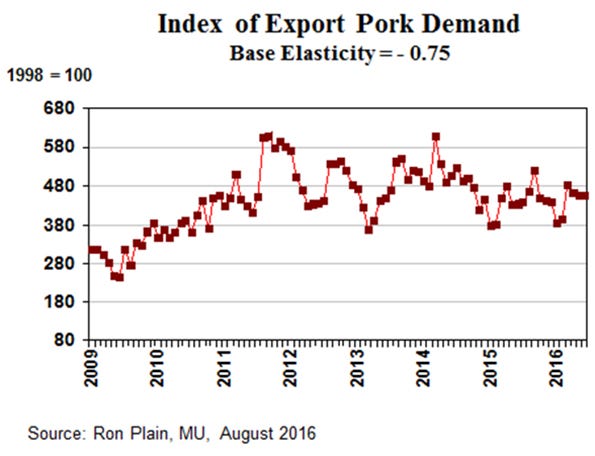

Export demand for U.S. pork was up 2.7% in the first six months of 2016, thanks to a 164% jump in exports to China. Export demand for beef, chicken and turkey were all down compared to the first half of 2015. Packer demand for live hogs was down 0.4% in the first half of this year.

About the Author(s)

You May Also Like