For Export News the Key is Value

While demand remains strong it's important to look at what buyers are willing to pay.

July 7, 2014

May export data are in and they point to another strong month for export demand. That statement doesn't mean the amount of product exported grew dramatically. It did not when compared to one year ago. But – everyone repeat along – "Demand is not consumption." Or, to paraphrase a bit, "Demand is not quantity." As Weekly Preview readers know, the other part of the demand equation is price and the value of U.S. exports was up sharply from year ago levels. Let's review some key May numbers:

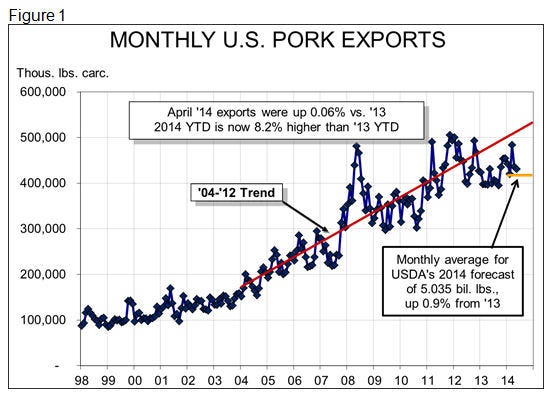

Total U.S. pork exports in May were 430.836 million pounds carcass weight, virtually unchanged from one year ago. That year-on-year performance measure is a bit disappointing relative to 22% rise in March and 10% bump in April but we are now somewhat removed from the panic buying of the spring and the reality of higher prices and lower supplies has hit export markets as well. As can be seen in Figure 1, the pace of U.S. exports remains just slightly higher than the monthly level needed to achieve USDA's latest annual forecast.

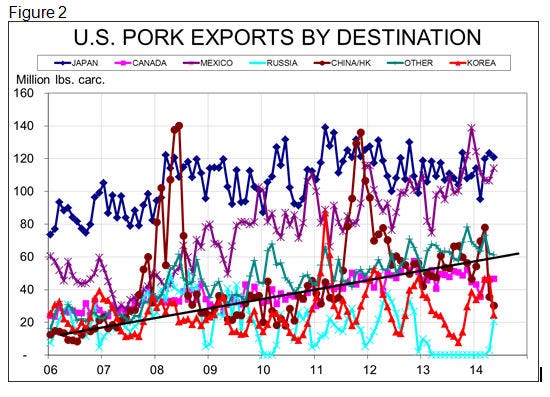

Japan was again our largest export customer, marking three months for back on top after three months in which Mexico was number one. See Figure 2. "Other" markets were a clear number three. These countries accounted for just over 14% of all U.S. pork exports in May and were led by Australia, Colombia and Philippines.

Russia purchased 20.7 million pounds of U.S. pork in May – largely because they have shut off most everyone else and had to buy some somewhere. May exports to Russia are the first of any significance since November 2012. Russia averaged taking 42.4 million pounds of U.S. product each month from January through November of 2012 so the May pace is still less than half of a more normal export situation with the Russians.

U.S. exports through May totaled 2.212 billion pounds, 8.1% more than one year ago. Year-to-date growth has been driven almost exclusively by China and Mexico where exports this year are leading those of 2013 by 46 million and 98 million pounds, carcass weight, respectively. Russia leads in percentage terms at +39% but that is based on very low shipments last year. China has taken 25% more U.S. pork this year but much of that growth has been offset by reduced shipments to Hong Kong. Total China/HK exports are up 7.7% versus one year ago through May.

The great news is that all of these shipments occurred at significantly higher prices than one year ago with the total value of U.S. pork muscle cuts hitting $516.2 million in May. That figure is 19% higher than one year ago. Since exports were virtually even with last year in terms of pounds, export demand would have had to be higher in order to push value – and prices -- higher by over 19%, year-on-year. The value of U.S. exports, year-to-date, was $2.419 billion, 16.2% higher than one year ago.

The caveat to all the good news is variety meats whose shipments were down 15.5% from last year in May and finished the month down 22.5% year-to-date. While quantities have been lower, prices have been good, with the total value of pork variety meat exports exceeding one year ago by 17% in May and 13.8% year-to-date through May. It certainly appears that pork variety meat buyers are far more price sensitive than are muscle meat buyers.

Was last week the beginning of the PEDV supply hole? Only time will tell but the weekly total of just 1.627 million head was the smallest FI slaughter total since July 4th week of 2006! The total was nearly 100,000 head lower than what the June Hogs and Pigs report suggested and about 35,000 lower than my forecast. The -8.8% year-on-year change figure for last week is the largest so far this year.

Though the July 4 weeks match between this year and last, this year's calendar may have still contributed to the low total. July 4, 2013 fell on a Thursday, meaning plants may have operated more aggressively on Friday and, especially, Saturday last year. Some plants likely did nothing on Saturday this year since they were already closed on Friday due to the holiday. I still expect year-on-year declines approaching 10% over the next 8 weeks or so.

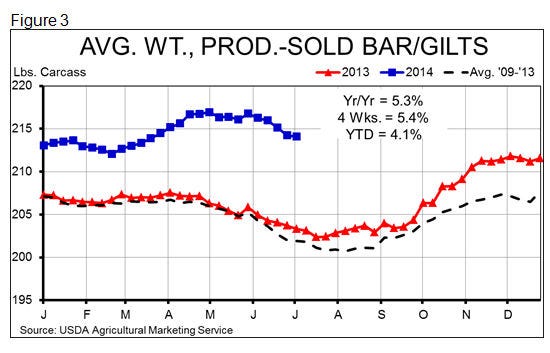

Producer-sold barrow and gilt weights dropped slightly last week to 214.1 pounds. That figure is still 5.3% higher than last year. The year-on-year increase in market weights has so far made up for virtually all of the reduction in pig numbers but will it last? As Figure 3 shows, weights normally decline by about 1.5 pounds from early July to their seasonal low in early August. Last year they bottomed in mid-July and then started higher when feed costs broke lower in anticipation of the larger 2013 crop.

We still expect a greater than normal seasonal decline in weights as packers dig deep in to available supplies to keep plants operating. But that larger-than-normal decline will not get near wiping out the year-on-year increases and may well leave the year-on-year gain at 4% or so.

And how do packers do that? By bidding higher for hogs. Today's prior day (ie. Thursday's) national purchase negotiated price was within pennies of its late-March high. The afternoon purchase price was $1.28 higher today suggesting that a new 2014 high will be set in tomorrow's prior day report. So much for my thought that the annual high was set back in March!

We apologize that our Prices and Production tables are not included today. USDA has not yet released all of last week's data due to Friday's holiday.

About the Author(s)

You May Also Like