September 14, 2015

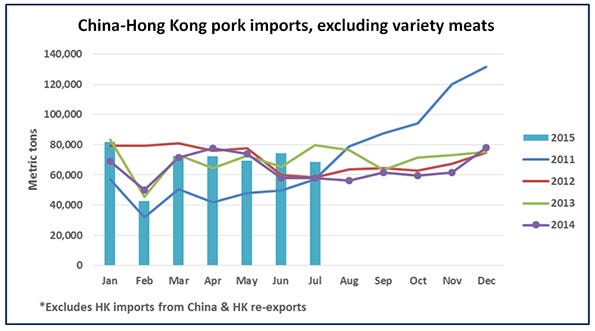

While most regions of the world are in a period of ample pork supplies, China’s imported pork demand has been firm. From January through July, China-Hong Kong’s combined pork and pork variety meat imports were up nearly 3% to 1.05 million metric tons, and China’s imports of pork muscle cuts gained further momentum in June and July.

In 2011, the last time China’s domestic pork prices spiked due to a decrease in production, monthly import volumes accelerated from August through the end of year, averaging 188,000 mt per month (see chart). This year China has seen a significant decline in its hog inventory following producer losses for much of 2014, so imports are likely to expand further in the final months of the year. The extent and duration of this increase in imports are uncertain, and U.S. access to China’s pork market remains limited.

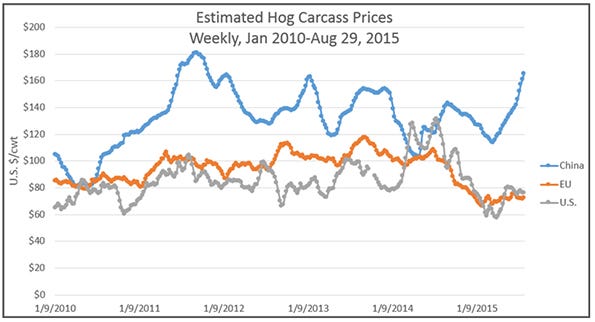

After moving steadily higher for several months, China’s live hog prices have stabilized recently, holding relatively steady for the past five weeks. Prices averaged 18.25 RMB per kilogram (or $1.30 per pound) in the first week of September, up 22% year-over-year based on data from China’s Ministry of Agriculture.

Stabilizing piglet prices

Piglet prices are up more than 40% year-over-year but have also begun to stabilize, averaging $2.48 per pound, and both hog and piglet prices remain below China’s 2011 peak levels. The hog:corn price ratio is now 7.54:1, compared to about 8:1 at this time in 2011. But the five-year average is 6.34:1 and the breakeven is considered to be about 6.1:1, so the current ratio indicates strong profitability as feed prices are decreasing while hog prices are increasing – although, the high piglet prices could slow China’s herd rebuilding process.

The spread between China’s hog prices and those in the United States and European Union peaked in early August, reaching record levels. China’s prices are now about 2.3 times higher than those in the United States and the EU.

U.S. and EU export data, as well as China’s import data, continue to show that the EU is reaping virtually all of the benefits of China’s current pork deficit. China-Hong Kong was the leading destination for EU pork/pork variety meat exports in the first half of 2015, with exports up 11% year-over-year to 600,836 mt and accounting for 45% of total EU export volume. U.S. exports to the region were down 18% to 185,404 mt over the same period.

China-compliant supply limited

Joel Haggard, U.S. Meat Export Federation senior vice president for the Asia Pacific region, explains that having a limited number of U.S. plants eligible to serve China – representing less than half the U.S. industry’s slaughter capacity – makes it difficult to capitalize on emerging opportunities in the Chinese market.

“Even for those U.S. plants that are eligible, it can be difficult to secure a reliable supply of China-compliant hogs,” Haggard says. “USMEF continues to work to develop new retail and foodservice customers for U.S. pork in order to increase our product’s visibility, but we clearly need more meaningful access to the market.”

The first-half statistics also reflect a very weak euro, which undermined U.S. pork’s competitive position versus EU product, especially for certain cuts and offal items that are difficult to differentiate by origin. The euro has strengthened somewhat in recent weeks, which is a positive trend for U.S. pork, but it is still down about 15% year-over-year versus the U.S. dollar.

You May Also Like