The hog market remains very sensitive to and dependent on pork exports.

Many hog operations have expressed quite a bit of concern about the future outlook of the market given expectations for increased hog slaughter and pork production later this year against a backdrop of questionable demand. While year-to-date federally inspected pork production is currently running about 0.7% below a year ago, and the USDA’s most recent quarterly Hogs and Pigs report indicated reduced farrowing intentions for the March-May and June-August periods relative to 2015, there remains concern that the market will be potentially oversupplied this coming winter. There has also been discussion that shackle space could become an issue given current slaughter capacity ahead of new facilities coming online in 2017.

On the demand side, pork exports year-to-date have been strong and many have pointed to the disparity between the prices for hogs in the U.S. versus China; however, the outlook going forward is less certain. There will be quite a bit of competition from cheaper beef and chicken as grills heat up this summer in the domestic market. Meanwhile, the Federal Reserve appears committed to maintain their monetary policy of gradual tightening with further rate increases beginning as early as June which could rekindle strength in the U.S. dollar. The hog market remains very sensitive to and dependent on pork exports, as over 20% of total production now goes to this market. Renewed dollar strength in combination with slower global growth would certainly not be a welcome development.

Manage risk

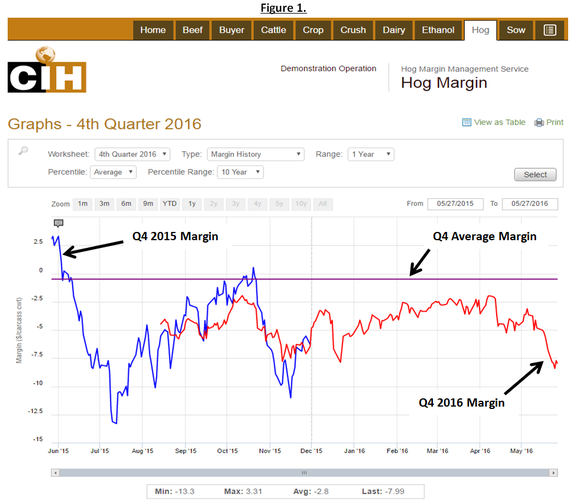

Amidst all the uncertainty, hog producers remain exposed to risk that needs to be managed. Looking at this risk from a margin perspective, the reality is that there has not yet been a favorable opportunity to secure attractive margins in Q4. Projected returns for a model finishing operation have remained both below break even and below average from a historical perspective when looking back over the previous 10 years (see Figure 1)

From a profitability standpoint, there would not have been a financial incentive to protect Q4 risk yet as margins have not really triggered the call to action that would typically invite forward contracting or positions on the exchange. What other factors may potentially trigger a producer to protect hog margins besides projected profitability? One might take into account seasonal considerations. For instance, when approaching risk from a margin perspective, are there certain times of the year that might prove more favorable for contracting compared to others – regardless of where forward margins are being projected? Figure 2 displays the seasonality for Q4 margins over the past 10 years. What this graph shows is that the early spring period from March to mid-April tends to correspond with a seasonal high for Q4 margins ahead of a gradual deterioration into the summer. A producer factoring this consideration into their margin management plan may therefore wish to establish some protection for Q4 in this time frame, regardless of the actual level of margins being projected.

For Q4 2016, while projected margins back in the spring would not have triggered a producer to establish protection based on profitability projections or historical percentiles, our clients nonetheless did choose to protect margins in this timeframe as their comprehensive margin management plans incorporate seasonality in the decision making process. As it turns out, Q4 margins have deteriorated since then due entirely to rising feed costs as Q4 hog prices have held relatively steady since early March. This brings about another point. Much has been made recently and attention focused on risk to hog prices based on the aforementioned factors. Less attention has been paid (until quite recently) to the cost of feed in the margin equation. Very few people were able to foresee the 50% rally in soybean meal prices that has unfolded since early April. Corn prices likewise are about 50 cents above their lows to go along with the $100/ton plus increase in meal prices.

The fact of the matter is that no one knows where the market is going or what factors may contribute to margin deterioration; however, a good comprehensive plan incorporates all aspects of a producer’s risk including input costs. A thoughtful plan also allows for other considerations besides historical percentiles or nominal margin levels to define the decision making process. With any plan, it is also important to stay consistent in your approach. This helps smooth our year-to-year volatility so that you can achieve your goals and objectives over the long-term.

About the Author(s)

You May Also Like