May 11, 2015

The big question facing pork producers right now is “Is there any more top side to this hog market?” It’s a tough call but part of what makes it tough for me is that the market has gotten to where I thought it would be. I sometimes tell a certain other person living in my house “You can’t take yes for an answer!” I find myself wearing that shoe today so let’s consider where we are and where we could go.

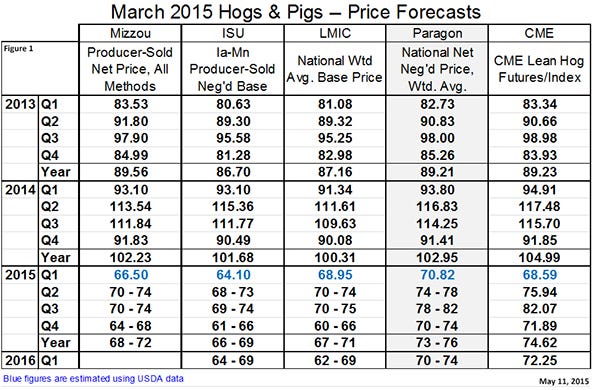

First, we have to recognize that Lean Hogs futures have rallied quite impressively since a neutral-to-slightly-bullish March Hogs and Pigs Report. Summer futures have added about $6 per hundredweight since the week of the report, and fall futures have added about $5. The rally has carried futures prices into my price forecast ranges – which admittedly look pretty optimistic relative to those of other analysts back in March (See Figure 1). That second quarter price of $75.94 includes the average Chicago Mercantile Exchange Lean Hog Index for April at just $62.26, so the strength of May and June futures has been impressive. July and August have traded above $84 and even December is within the fourth quarter range now.

A few weeks ago I admonished producers to not get greedy if LH futures were to get near the top of my price forecast ranges. Well, they are there. Now all of us have a bad case of the “Yeah buts” as we see uptrending markets and several items that suggest more could be in store.

Positive supply factors

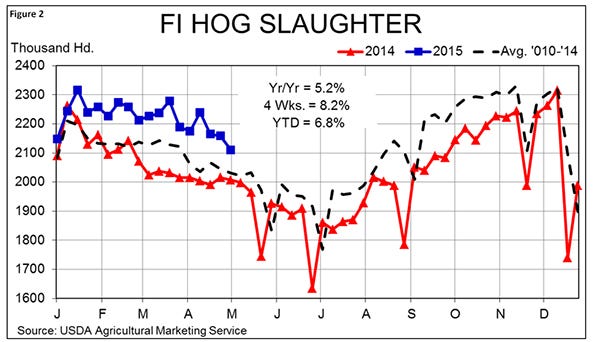

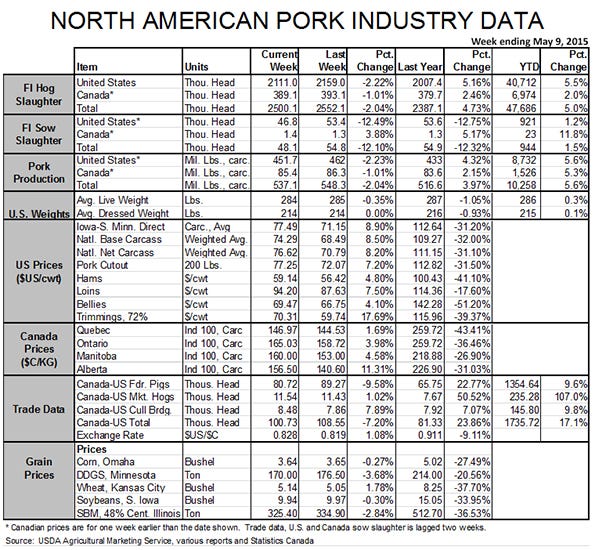

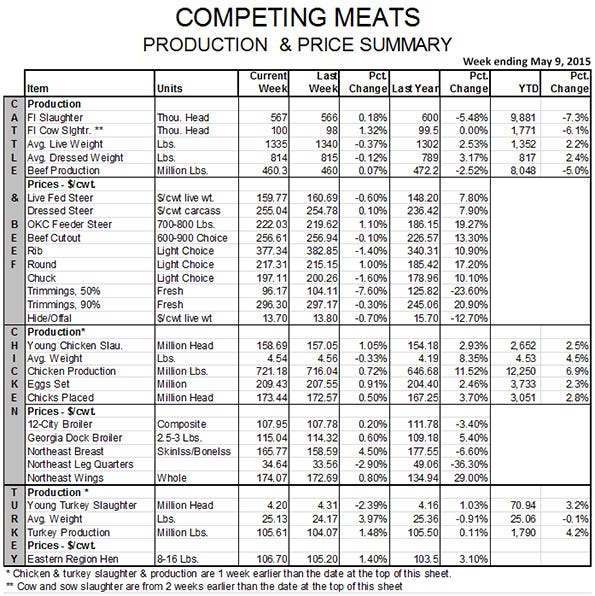

On the positive side are a number of supply factors. Last week’s FI hog slaughter of 2.111 million head was the smallest yet for 2015 and was “only” 5.2% higher than one year ago (See Figure 2). That’s the smallest year-on-year increase since the first week of February. Canada’s slaughter was 1% lower than the prior week and only 2.5% higher than last year, leaving North American slaughter up 4.7% from one year ago.

U.S. slaughter has fallen at a pretty reasonable seasonal rate since mid-March, but should last week’s decline be duplicated, I will begin to suspect that the seasonal decline has gotten faster than normal. That could well be indicative of producers finally being “caught up” with marketings which I have contended for several months have been pulled forward as producers tried to sell hogs before prices got lower and had to make room for more pigs than their “heavy hog” production plans could accommodate as the impact of porcine epidemic diarrhea virus waned.

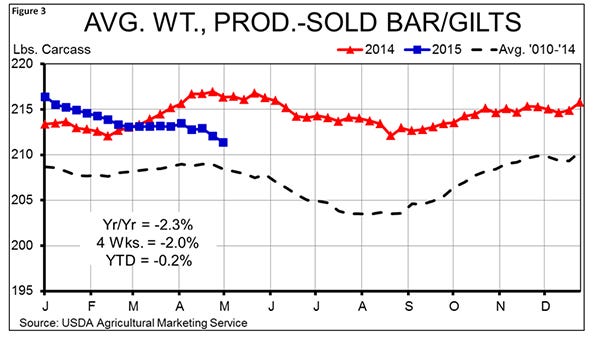

The fact that belies the “caught up” conclusion, though, is that average hog weights are once again falling rapidly (See Figure 3). The average weight of producer-sold barrows and gilts reported under the mandatory price reporting system has fallen by 1.5 pounds in just two weeks and is now 4.5 pounds (2.3%) lower than one year ago. This suggests that producers had to dig deeper into their finishing barn inventory to get as many hogs as they had committed to packers the past two weeks – even as slaughter totals declined.

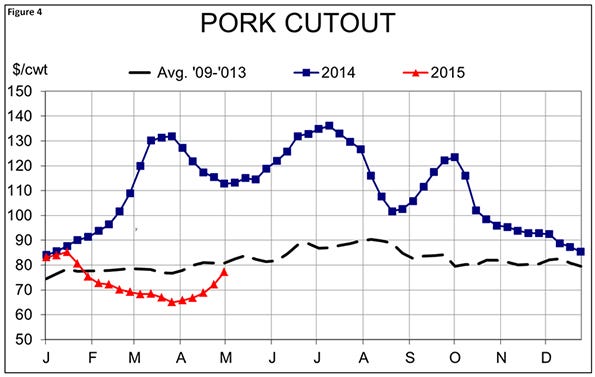

Part of that interest in selling hogs could be concern that futures and cash markets have gone as far as they might. The key to determining an answer will be what happens to the cutout value. Last week’s gain was an impressive $5.18 per cwt or 7.2% as the cutout posted its highest weekly average since late-January. That gain barely kept up with the cash market, keeping packer margins tight. The packer guys I know are great people but they are not at all altruistic in their bidding for hogs. Margins have to improve – or at least they can’t decline – if packers are to continue to raise their hog bids. For either of those to happen, the cutout has to continue to rally.

Even here there is good news as a number of downtrodden wholesale cuts have seen their values show signs of life in the past few weeks. The loin primal composite value has gained more than $12 (15%) in just three weeks. The butt primal value has increased from $80 to $98 in that time, and 72% CL trim has gained more the 50% from its sub-$40 late-March low to reach $60 last week. Ribs are nearly $30 per cwt higher than they were one year ago. Ham prices have improved but still lag last year by 40% or so and belly prices are, relative to recent history, still abysmal. This discussion is far more positive than just one month ago!

So what do you do?

If your balance sheet and/or intestinal fortitude are weak, and you have taken no protection on summer hogs, price some of them now. One-fourth to one-third sounds reasonable with the higher side recommended for anyone who just can’t stand risk either financially or psychologically.

If neither of those conditions applies to you – and I think many readers fall in this group – keep your powder dry, but watch for any signs of this market breaking over the next four to six weeks. June LH just penetrated resistance at $84 suggesting some upside with the next objective being past support at $88.75. That sounds very ambitious to me but that’s what the chart says. July, August and October are bumping key resistance which will provide new support should it be penetrated. December just moved through resistance at $70 with its next objective being January resistance at $73.50.

My cost model has 2015 profits just below $10 per head assuming mid-day May 11 futures prices for hogs, corn and meal and equal marketings in each month. That average includes June-to-August profits of $30.33, $31.50 and $29.96, and black ink through year’s end. That is much better than many thought would be available just six weeks ago.

There are some good reasons to wait, but my warning still applies: Don’t get greedy.

About the Author(s)

You May Also Like