June 18, 2012

I got the distinct impression at World Pork Expo that some people were thinking that “Steve Meyer has lost his mind – a big hog rally and corn at $4/bushel!”

For the record, I didn’t say corn is going to get to $4.00/bu. What I said was, “If rainfall is normal this summer, corn could get to $4.00/bu.” That’s a big “if” at present, even though Iowa got some help over the weekend. The rainfall was far from consistent, though, and it didn’t get to the eastern Corn Belt at all, which led to sharply higher corn and soybean futures on Monday morning. New crop soybean meal prices hit contract life highs on Monday.

There are also scenarios for corn costing $6.00/bu. – possibly more. Forecasts call for more rain next week, even in the eastern states. Current conditions and hot weather are underscoring the need for timely rains in most areas.

The hog rally is another matter entirely. Friday saw the national weighted average base price for negotiated hogs at $97.18/cwt., carcass, up nearly $3.00/cwt. from Thursday and up nearly $9.00/cwt. from one week earlier. Iowa-So. Minnesota reported negotiated hogs as high at $103/cwt., carcass, and the weighted average price of negotiated hogs at $100.09/cwt. The average net price for those hogs will be roughly $103/cwt.

There is nothing really magical about this rally. It is driven by two long-standing, rally-driving factors – higher cutout values and lower hog numbers.

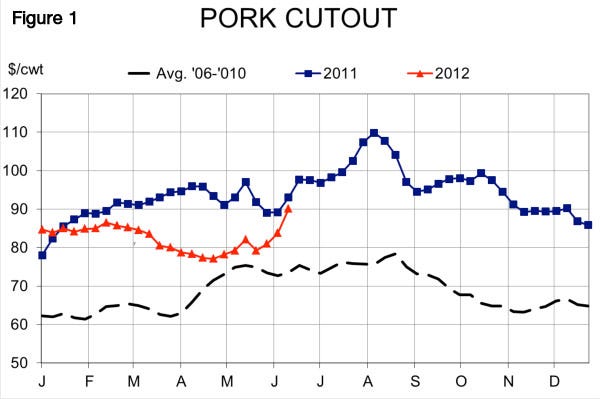

USDA’s estimated cutout value for 51-52% lean carcasses hit $94.12/cwt. on Friday, also nearly $10 higher than one week earlier (Figure 1). The weekly average cutout value was $90.12/cwt., 7.5% higher than last week. That is the highest weekly cutout value of the year, so far, and just $2.91 lower than the same week last year.

The rally has been driven by traditional summer favorites. Primal composite values for loins, ribs and bellies gained $13.62, $28.00 and $10.97/cwt., respectively, last week. Butts and hams increased $6.84/cwt. and $7.17/cwt., as well.

It will be interesting to see how the rally in pork cut prices may correspond to tighter freezer stocks in the USDA Cold Storage report, which will be released next Friday. That report will reflect May 31 stocks, so we may not see a lot of movement yet, but this kind of rally suggests the near record-large April 30 inventories are no longer hanging over the market.

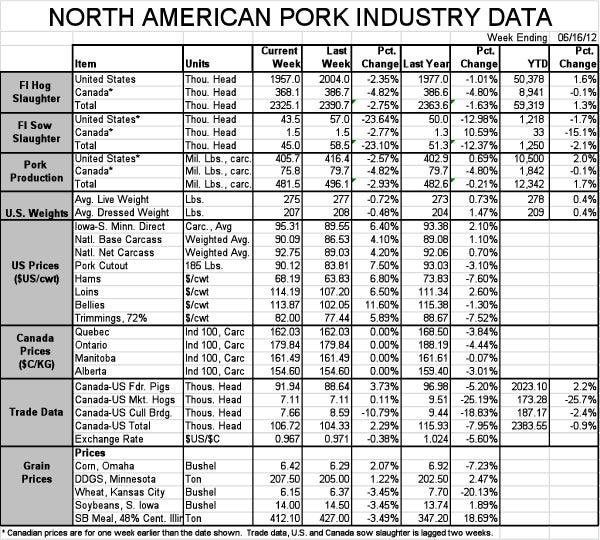

The other factor is significantly lower hog numbers (Figure 2). Last week’s total slaughter was 1.957 million head, 1% lower than last year and 3.5% lower than I had predicted based on USDA’s March 1 hog inventories. This marks the first time since the first week in March that federally inspected hog slaughter has been smaller than one year ago and the first significant shortfall vs. the predicted levels since the March Hogs and Pigs Report was published.

Why the shortfall? We’ve talked quite a bit about the argument that hogs had been “pulled forward.” The argument has more and more validity as each week of below-expected slaughter is seen. The break in numbers is probably too late to be attributed to last year’s heat unless one buys the idea of slower daily growth due to diets with less energy. By accepting that explanation, however, one doesn’t explain the higher hog numbers in April and May. The same goes for losses attributed to porcine reproductive and respiratory syndrome (PRRS), but the timeframe for seeing these is July and August. We’ll see if this one shows up.

Finally, there is always the possibility that USDA simply miscounted (or producers simply inaccurately reported) the inventories in the first place. While not near the moving target it once was, the producer base for the survey sample may have become more fluid than it was in the past as grain prices rose and some smaller operators exited. The size of the revisions in the June 29 report will be interesting indeed.

About the Author(s)

You May Also Like