China’s pork imports record large in 2015

The spread between U.S. and EU hog prices and China’s prices remains historically wide.

February 15, 2016

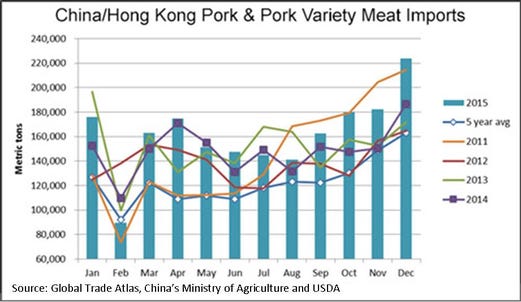

Despite slowing economic growth and slackening demand for commodities, China imported record volumes of pork and pork variety meat last year. December imports into China/Hong Kong totaled 224,000 metric tons (mt), up 20 percent year-over-year, pushing imports for the full calendar year to 1.937 million mt, up 8 percent.

The European Union was the primary beneficiary of China’s growing pork imports, with about 70 percent market share. But U.S. exports gained momentum toward the end of 2015 after several U.S. plants regained eligibility to export to China. In December, U.S. pork/pork variety meat exports to the China/Hong Kong region posted the largest volume in nearly two years at 33,691 mt (up 27 percent year-over-year). For the full year, U.S. exports to China/Hong Kong edged 1 percent higher in volume (339,056 mt) and were down 10 percent in value ($700.4 million) compared to 2014. However, these results were still down 4 percent in volume and 22 percent in value from 2013, and down 30 percent and 23 percent, respectively, from the 2011 peak.

As China began shutting down for the week long Lunar New Year holiday, meat traders were anxious about prospects for the post-holiday period, when consumption usually trends seasonally lower. China’s live hog prices continued to move higher through the third week of January, up 37 percent year-over-year at 18 RMB/kg ($1.24/lb). Prices are being partly driven by seasonal holiday demand and cold weather. Piglet prices have soared, up 74 percent from a year ago to $2.31/lb, reflecting strong profitability in the industry, and thus demand for feeder pigs.

Historical wide price spread

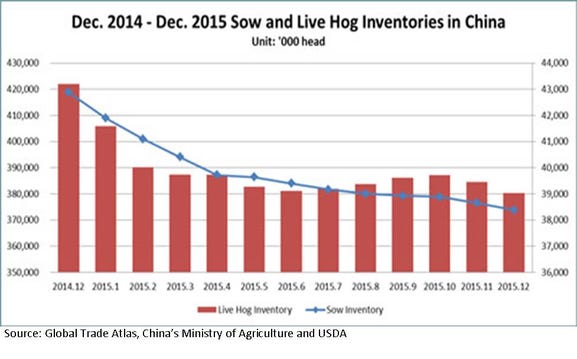

Live hog and piglet price trends are similar to 2012, following a drop in production and subsequent price spike in 2011. Of course the decline in China’s breeding herd over the past year has also limited the number of piglets. China’s corn prices were recently down 13 percent year-over-year to their lowest level since 2011, but still averaging more than $8 per bushel, based on official Ministry of Agriculture data. Combined with higher hog prices, this put the hog: corn ratio at 8.58:1, indicating the highest profitability in recent history and raising expectations for a rebound in production by mid-year. Experts are divided, however, on how fast the industry can ramp up production with new environmental regulations pinching expansion plans, especially for larger operators.

The spread between U.S. and EU hog prices and China’s prices remains historically wide, with China’s prices staying nearly three times as high as U.S. prices since December. This should mean continued opportunities for U.S. exports, but wholesale prices for EU pork cuts in China remain extremely competitive. Also, the wholesale market was relatively calm ahead of the Lunar New Year holiday, but importers continued to buy as imported pork is clearly a value compared to domestic product. China’s wholesale prices for imported variety meats were mixed in the first part of January, with higher prices for feet and stomachs while ear prices were sharply lower and tongue prices eased. Importers are hedging on continued devaluation of China’s currency, which could further impact pricing.

The spread between U.S. and EU hog prices and China’s prices remains historically wide, with China’s prices staying nearly three times as high as U.S. prices since December. This should mean continued opportunities for U.S. exports, but wholesale prices for EU pork cuts in China remain extremely competitive. Also, the wholesale market was relatively calm ahead of the Lunar New Year holiday, but importers continued to buy as imported pork is clearly a value compared to domestic product. China’s wholesale prices for imported variety meats were mixed in the first part of January, with higher prices for feet and stomachs while ear prices were sharply lower and tongue prices eased. Importers are hedging on continued devaluation of China’s currency, which could further impact pricing.

China annual livestock production

National Bureau of Statistics data show that China’s annual livestock and poultry production in 2015 was 84.54 million mt, down 1 percent compared to 2014. Pork production was down 3.3 percent from the previous year to 54.87 million mt. Enforcement of environmental regulations pushed many small hog farms to exit in 2015, resulting in a continued drop of both sow and live hog inventories. At the same time, China’s industry continues to make efficiency improvements as it transitions from backyard to commercial production.

Although flush with large domestic stocks, China’s grain imports were also record-large at 32.6 million mt, a 68 percent increase over 2014, as China’s corn policy effectively kept China’s prices at more than double the world price. The U.S. was the largest supplier with 10 million mt, primarily sorghum. China’s imports of distiller’s dried grains with solubles (DDGS) from the U.S. were 6.8 million mt, up 26 percent. China’s soybean imports exceeded 90 million mt, up 13 percent, primarily from Brazil, the U.S., and Argentina. But the global grain industry is watching with concern as China modifies its corn policy and will likely import a lower volume of feedgrains in the near term (though soybeans remain the exception). One sign that the Chinese government might try to manage feed imports this year is that it recently announced another anti-dumping investigation on imports of DDGS.

You May Also Like