Growth in the pork export market may be the decisive factor.

May 2, 2016

Perhaps the most frequent question I hear these days is “What will be the impact of all of these new hog plants?”

It’s an understandable and important one that is pretty difficult to answer with much certainty, but let’s consider some of the factors that will determine impact and, where possible, at least the direction of those impacts. The magnitude of impacts is almost impossible to determine because so many other factors — domestic demand, export demand, hog numbers, timing of growth, etc. — will be at play. Cop-out? Perhaps. But fact nonetheless!

First, we need to remember than not one pig that is ready for slaughter this year will be left alive due to the lack of a time slot for it at a packing plant. That means there are no “extra” hogs just as there were no “extra” feed ingredients six years ago. You can’t imagine the number of reporters who called and asked “Why don’t they just feed them something besides corn?” Similarly, there is nothing “besides a pig” that will suffice as a raw material for a packing plant and every one of them that were available last year were slaughtered. Same goes for this year. And the same will go for next year.

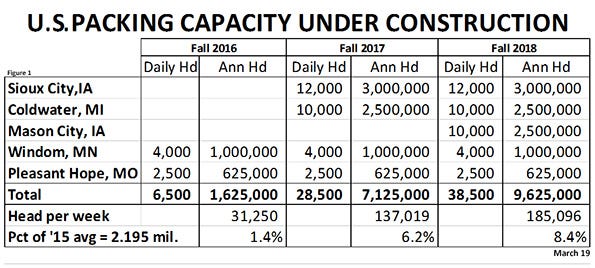

It is true that there will be plenty of hogs available this fall — just as there were last year. We have fourth quarter slaughter up 2.9% and, depending on exactly when those hogs hit market weight. That could cause some trouble. New plants in Windom, Minn., and Pleasant Hope, Mo., will add about 1.4% to our weekly slaughter capacity if they are in fact up and running by the fourth quarter. The Missouri company is saying August. The Minnesota group says nine months when they announced the effort in early February. Should both be up and running, they will keep hogs from being extremely cheap this fall but we do not expect prices to average $60, which means some prices in the low- to mid-$50s are still likely.

The Sioux City plant is a joint venture between Seaboard Foods and Triumph Foods. Their original announcement said each company would provide one-third of the pigs for the plant and that the other third would be bought on the open market. At their 12,000 head per day startup rate, each third works out to be one million hogs. Seaboard has acquired a set of sows in Iowa from Christensen Farms. I have heard anywhere from 25,000 sows to 33,000 sows were in that deal. Even the highest number would still be somewhat short of 1 million pigs per year so we suspect they will add more sows either through new construction or further acquisition.

Triumph members have, we think, been shipping pigs to other packers as well as supplying their current St. Joseph, Mo., plant. They may not have to add many sows to supply their 1 million pigs but if they do not, those million hogs will become unavailable to their current packers. Then there is the million head from the open market that will also come from somewhere. Even with aggressive expansion, it will be difficult to replace those animals at other packing plants.

Ditto for the hogs going to Coldwater, Mich. There will be some expansion and some number of hogs imported from Ontario, but most of the hogs that will be available to that plant at startup are going to be pulled from other packers. We got a glimpse of that this past fall when, right during the time when total capacity was being challenged, one eastern Corn Belt packer was frantically looking for hogs. The reason? Hatfield had finished the expansion of its Pennsylvania plant and one of its future partner-suppliers for the Michigan plant began shipping hogs east, leaving the ECB packer with unfilled shackles.

Factor II

After all of that, the second thing we need to remember, though, is that those plants will not need 5.5 million pigs in 2017. They won’t even need the full one-half year supply of 2.75 million pigs. But the ones they begin processing will leave supply voids at the margin and drive up hog prices.

Packers make no money with empty shackles and make more money when they can spread those plant and labor costs over more and more pigs. They will not just stand by idly as hogs are bid away. There is a limit to how much they will bid, but I’m confident the amount will be greater than zero!

Factor III

The third factor becomes Prestage’s entry in 2018. Prestage has announced that they will supply about half of the hogs to that new plant and they have some time to increase their production.

The lion’s share of the sows that will supply those pigs are already down and many of their pigs that will one day travel to Mason City, Iowa, are now going to other plants.

Factor IV

How fast will the plants ramp up second shifts? We have heard of no double shift talk from the two smaller plants. Triumph has said they will start working on a second shift as soon as the first is full, and my guess is that will happen by early 2018. That’s just a guess.

Hatfield’s plant can ramp up to 12,000 per day on 10-hour shifts, but we have not heard of further increases, at least with the existing structure. I would be surprised if all three of the big plants cannot double the numbers in Figure 1 if profits are good. It may take additional cooler and fabrication floor space but I’m betting that is doable.

Factor V

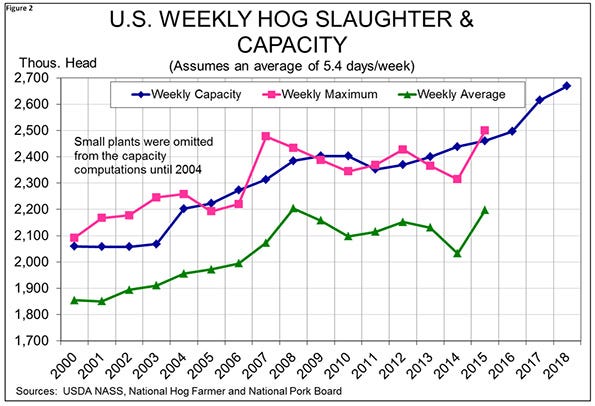

What will the supply impacts be if we fill the plants on schedule? Double shift one or more of the big ones quickly? Double shift all three of the big ones? As can be seen in the table, all five plants operating at single shift would represent 8.4% more hogs than the average daily slaughter in 2015. That would not all be on board for all of 2018, but it would be for 2019. So we could have a 6+% increase in 2018 plus 1% or so more from two years of 0.5% growth in average weights. Seven percent more pork in two years is a bunch. Add another 2.2% to slaughter and 0.5% to weights in 2019 and you have another 2.7% for a total of nearly 10% in three successive years. U.S. population is growing at roughly 0.7%, so per capita availability will increase sharply.

If exports grow at the meager rate of recent years, they will pull only about 1% more of total production each year. That leaves about 1.5% more pork each year that needs to go somewhere to keep prices reasonable. Can we export that much more? The answer to that question will likely be the decisive factor.

About the Author(s)

You May Also Like