August 12, 2013

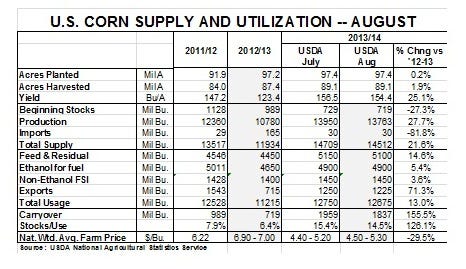

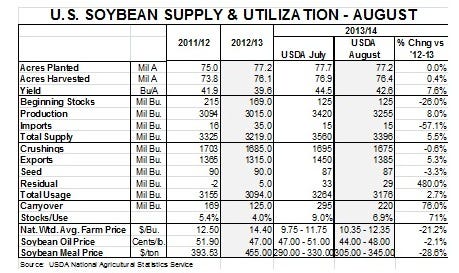

Is the opportunity for the lowest possible costs for the next crop year gone? That depends on a lot of factors, but today’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA predicts lower-than-expected yields and, consequently, higher prices than futures markets had been reflecting. USDA’s actual forecasts for corn and soybean supply and usage appear in Tables 1 and 2 of today’s report.

Table 1.

Table 2.

Some highlights and implications of today’s reports are:

A forecast corn yield of 154.4 bushels per acres is over 3 bushels lower than the average of analysts’ pre-report estimates, and just barely larger than the lowest of those estimates. Thus, it is no surprise that corn futures are higher this morning but the reaction, in my opinion, is pretty mild at just over 10 cents per bushel for February and March corn at the time of this writing. That tells me that there wasn’t a lot of conviction about the average 157.7 estimate – a lack of conviction that is pretty well founded given last week’s Drought Monitor map that reflected continued deterioration of the moisture situation in Iowa, Missouri, Nebraska and southern Minnesota.

The lower yield given a lower crop size of 13.8 billion bushels – still a record but not quite as large of a record as had been forecast by trend yields.

The only changes USDA made to usage were slight reductions to feed/residual (-50 million bushels) and exports (-25 million bushels).

The net of the changes took projected year-end stocks to 1.837 million bushels, 122 million bushels lower than last month, but still 155% higher than this year’s estimated 719 million bushels. That level puts projected 2014 year-end stocks-to-use ratio at 14.5. That figure is within 2 points of the levels of 2007-2009 when corn prices averaged about $4.00/bu. for the year. We will not likely get there this year but it puts today’s $4.60-$4.80 futures into some context.

The average soybean yield is predicted to be 42.6 bushels per acre, almost 2 bushels lower than USDA’s July forecast and about 1 bushel lower than the average of analysts’ pre-report estimates. It is my opinion that there is still substantial risk for soybeans due to late planting. New crop bean futures are all in the $12.35-$12.45 range where the mid-point of USDA’s predicted average farm price is $11.35.

The lower crop, plus reductions in projected crush and exports, caused the forecast year-end soybean stocks to fall to 220 million bushels from last month’s 295 million. It is still 76% larger than projected year-end stocks this year.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

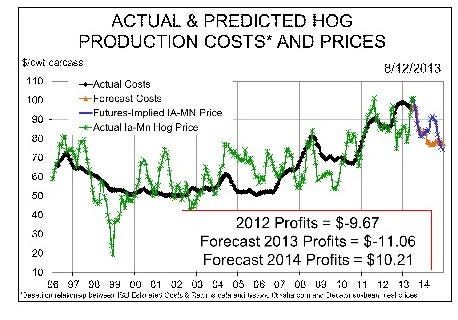

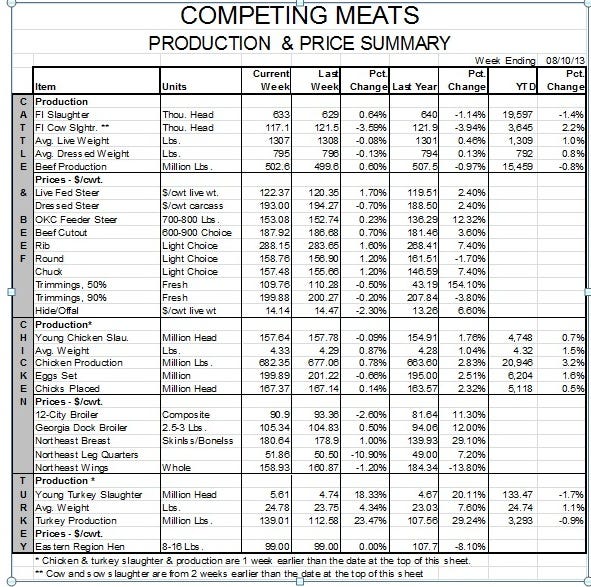

The net impact is to raise projected hog costs from recent levels but put them at their lowest level since 2007. See Figure 1. My model had said $74 and change last week but I don’t know of anyone who will gripe much about the $79 figure resulting from today’s report. Profits of just over $10 per head would make 2014 the best year since 2010’s $12.92 per head.

Figure 1.

You might also like:

Former Florida Hog Farmer Awarded $505,000 for Constitutional Amendment

You May Also Like