Russia Embargo No Surprise; But What Does it Mean?

August 11, 2014

Show of hands: How many of you thought “Russia is embargoing imports? Now there’s a shocker!”

That was pretty much my thought in a nutshell. The only difference is that this time they aren’t offering some food safety or “concern for our citizens’ well-being” as the reason. Whether you agree with it or not, this one is based on a pretty obvious driver: Other countries are sanctioning them. The fact that they reacted should be no surprise at all.

But how will it affect us? That’s the question that many are asking. Based on the talk and last week’s market action, one would not conclude this is the end of the world but would conclude it is significant. Psychologically that may be so but the numbers don’t support it. Consider:

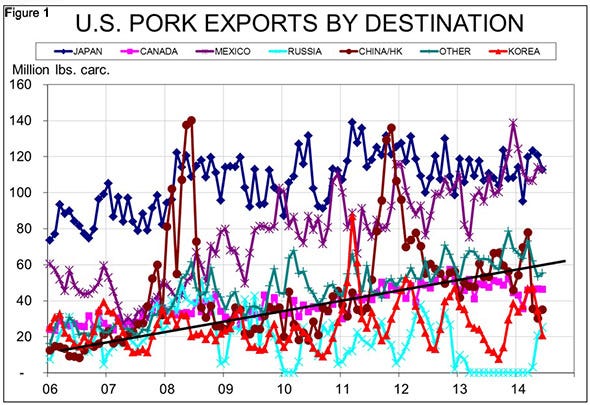

From March 2013 through April 2014, Russia imported exactly 40,000 pounds, carcass weight, of U.S. pork. One container full in 14 months. See Figure 1.

Since April, Russia’s purchases from the United States have been growing but still amounted to just 20.7 million and 25.1 million pounds, carcass weight, in May and June. Those figures are 1.1% and 1.2%, respectively, of U.S pork production in the two months. Those figures would represent about 0.9% and 1.0% of total U.S.-Canada pork output

Canada’s shipments to Russia have amounted to 8.2% of Canadian pork output so far in 2014. That figure represents roughly 1.4% of combined U.S.-Canada output.

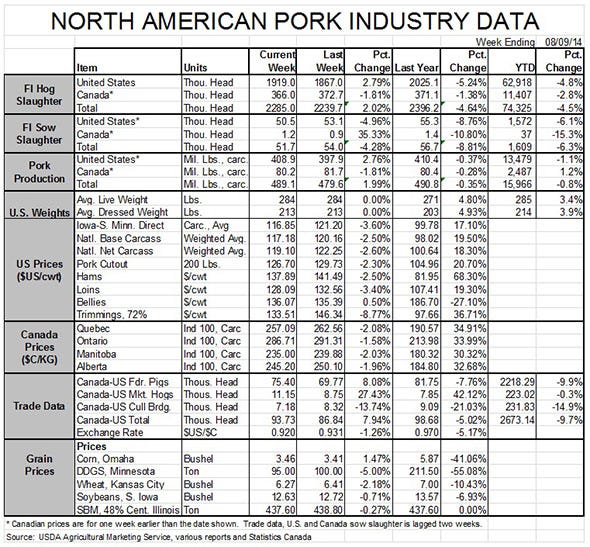

It appears that the Russian decision will cause about 2% to 2.5% more pork to be placed on the U.S.-Canada market relative to recent levels assuming no other home can be found for that product. Any product that Russia buys to backfill the shortages will have to be pulled from some current market, opening an opportunity for pork from the United States and Canada. Some will no doubt have to be sold on this continent but even if it is all sold here, I would expect the price impacts to be in the 5% range. October Lean Hogs futures are down about 3% from Wednesday’s close. The price impacts will get smaller as time goes by and markets rationalize.

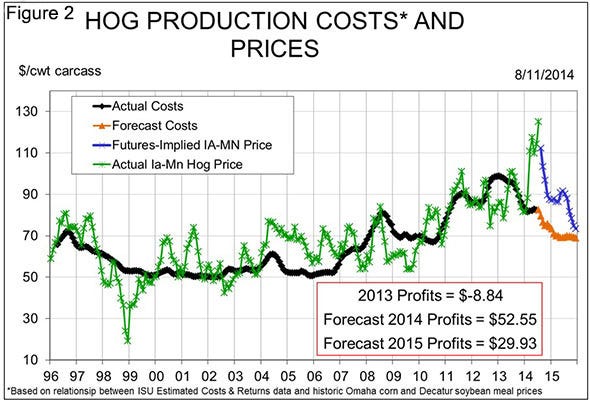

New crop corn and soybean meal futures have found comfort ranges – at least for the moment – near $3.50/bushel and $350/ton, respectively. Those prices will put hog production costs near $70/cwt. carcass weight according to our model based on Iowa State University’s Estimated Costs and Returns. The U.S. Department of Agriculture’s August Crop Production and World Supply and Demand Estimates are due out tomorrow and analysts expect the USDA to raise its estimated corn yield to just over 170 bushels per acre and to raise the estimates soybean yield to 45.6 bushels per acre. Both would be new records and would lead to record-large U.S. crops.

It looks almost certain that hog production costs in the coming year will be the lowest since 2010. Both crops are still susceptible to an early frost but crop conditions have been excellent and progress is, if anything, a bit ahead of normal for both.

Though forecast farrow-to-finish hog margins have fallen in the past three weeks as Lean Hogs futures have declined, projected margins of $52.55/head as of today for 2014 are still record-high. Today’s forecast of roughly $30/head for 2015 would make it the second best year on record for U.S. pork producers.

About the Author(s)

You May Also Like