It's time to talk about how the value of pork is being spread among the people who create that value.

April 15, 2013

Happy Tax Day! There’s an oxymoron if ever there was one. But look on the bright side – the marginal tax rate isn’t 100% yet.

I had a pastor once who, from time to time, would begin a sermon with, “It’s time we had one of THOSE talks again.” What followed was never pleasant for him or for us as he would remind us of the difficult things the Bible teaches – help those in need, love those who are difficult to love, be careful to separate needs and wants, wear modest clothing.

Well, it’s time for one of THOSE talks about how the value of pork is being spread among the people who create that value. I don’t delve into price spreads too often, primarily because they are a powder keg. Many producers feel like everyone who handles the various parts of their pigs is to some degree a blood-sucking parasite who makes too much money and doesn’t pass enough of the value along. Packers sometimes see high retail prices and decry the power of the retailer. Retailers point to the ongoing arms race of bigger, fancier stores on pricier and pricier land and proclaim that they “have to cover the costs here!” And they can always rightfully say, “By the way, we don’t have to sell your product.”

You can see how it gets very messy, very fast.

In the long run, the value of pork at the retail level has to be divided in a manner that keeps everyone in business. Retailers must realize a margin on their store that is large enough to pay the costs and provide a return to investors. Ditto for packers and their plants and for producers and their farms. But there are two pitfalls in these statements.

First, what must hold in the long run (a period of time long enough for the level of all inputs to be variable) does not have to hold in the short run. While everyone who remains in the business must earn a living, those who exit do not, by the very action of their exit, do so. And even those who survive in the long run will not prosper all of the time. Those are the times when having one of THOSE talks happen.

Second, note that the retailers’ ultimate objective is store profits, not product profits. Making money on every product in the store is the goal, but the profits differ and some products have to carry more of the load to get the average high enough to make the business attractive and keep capital invested.

Whether we like it or not, pork has traditionally been one of the products that contribute positively to overall store margins. I believe that has become even more the case as chicken has claimed a larger market share and become more of a staple in many households. Chicken breasts have joined ground beef as traffic drivers, while both fresh and processed pork have been used to make the average meat case margin acceptable.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

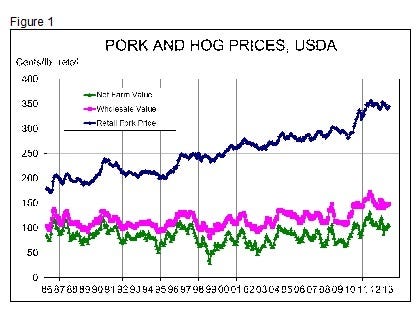

For the first time in a few years, I have heard some grumbling about margins. Part of that is due to the huge jump in retail pork prices that occurred in 2010 and 2011 (Figure 1). Part of it is due to disappointment in this spring’s wholesale pork and hog markets. Domestic demand has not been stellar but neither has it been bad. Export challenges have negatively impacted wholesale and farm markets.

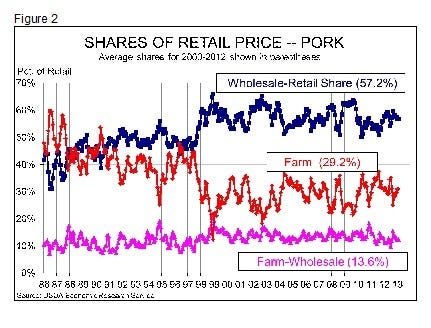

But the shares of these near-record retail prices being captured by each level of the chain have not changed much. As Figure 2 shows, the wholesale-retail share is higher than last year but lower than at many times since 2000. The farm share is just the opposite – lower than last year but higher than at many times since 2000. Packer margins are well within their range of the past dozen years as well.

And the averages have changed little. When I changed the average formulas in this chart to include 2011 and 2012, the numbers changed by no more than 0.3%.

So are downstream margins too high? Maybe. We’ll know more this week when March data are released by USDA's Economic Research Service (ERS). Given the struggles of the pork cutout the past few weeks, I suspect that the wholesale-retail margins will be higher. But that doesn’t mean it will stay there. Tighter hog supplies will push up hog and cutout values and the anticipation of that change is one reason retail prices have not declined. Retailers don’t want to change prices very often, especially when increases create a backlash with customers. So to avoid increases retailers don’t reduce prices very quickly, often leading to wider margins when producer- and packer-level markets struggle.

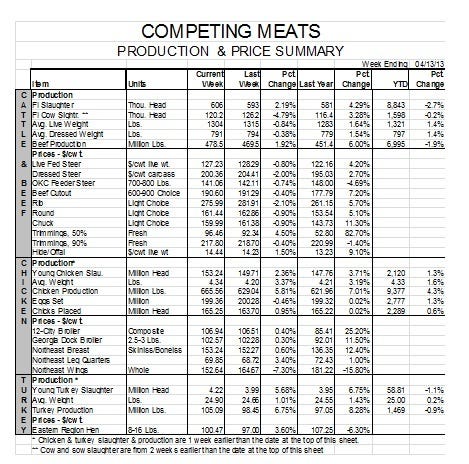

But wide margins are an opportunity as well. Pork featuring should increase, especially with wholesale pork prices near record low levels relative to Choice-grade beef and lower relative to chicken than at any time since 2010.

Should we talk about these issues that make us uncomfortable? Of course, but I think my pastor had it right – talking about them in a calm, fact-based, gracious manner accomplishes a lot more than bludgeoning with anger and blunt force. Always remember, you catch more flies with honey than with vinegar.

You might also like:

Congressman says “Renewable Fuel Standard is not Working”

You May Also Like