January 27, 2014

The Minneapolis Star Tribune newspaper recently reported on the impact the propane shortage is having on Minnesota livestock producers. The paper quoted David Preisler, executive director of the Minnesota Pork Producers Association, as he explained that some of the state’s pork producers have been told by suppliers that they do not know when their next propane shipment will be arriving. As pork producers in cold-weather climates are well-aware, the problem is not limited to Minnesota.

The National Pork Producers Council (NPPC) is concerned for U.S. pork producers because in some regions of the country, distributors are rationing supplies. The National Propane Gas Association indicated that Minnesota, Missouri and Wisconsin have been particularly hard hit, but that spot shortages have occurred through the Midwest, Northeast and Southwest. Because most customers receive their propane by truck, the U.S. Department of Transportation recently issued emergency orders for 10 Midwestern and 12 Northeastern states, suspending the limits on the amount of time truck drivers can spend on the road.

The U.S. Energy Information Administration (USEIA) released a report last week on the propane supply situation. The report said that the onset of severely cold weather in recent weeks led to the extremely tight Midwestern propane supplies. According to the USEIA, the high propane prices in the Midwest are the result of both increased demand for crop drying in November and increased demand for space heating in the current cold weather.

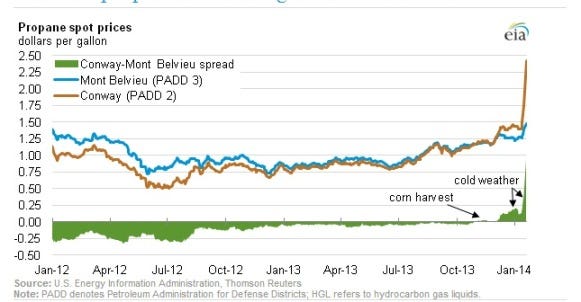

A late-2013 corn harvest, along with cold, wet weather, resulted in strong demand for propane needed for drying corn (See graph above). For the week ending November 1, 2013, Midwest propane inventories dropped more than 2 million barrels, the largest single-week stock draw in any November since 1993. This demand prompted a strong upward price response, and propane at the Conway, KS, terminal moved to a 3-cent-per-gallon (gal) premium over Mont Belvieu, TX, during the first week of November, the first such premium in almost three years, according to report.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

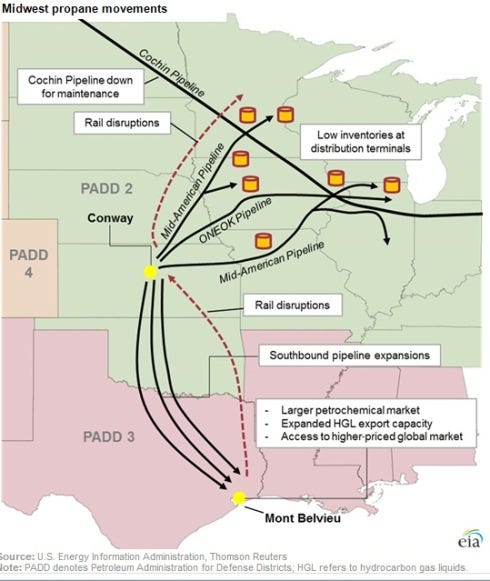

After the harvest, logistical problems prevented the region from fully replenishing inventories before the onset of winter. The Upper Midwest is supplied with propane by pipelines (Mid-American and ONEOK) flowing north from Conway (home to 30% of the nation's propane storage), the Cochin Pipeline coming south from Canada, and from rail deliveries. The Cochin Pipeline, which delivers ethane and propane from Canada to the Upper Midwest, was out of service for maintenance from late November to December 20 and unavailable to deliver supplies. Rail transportation disruptions, both due to weather and other factors, curtailed deliveries from Mont Belvieu and Conway, as well as from Canada (See Figure below).

The most recent cold weather increased space-heating demand at a time when markets were already tight. As demand outpaced supply, inventories dropped further, by 1.5 million barrels and 1.2 million barrels for the weeks ending Dec. 6 and Jan. 3, respectively. Since the week ending Oct.11, Midwest propane inventory levels have dropped by 12.8 million barrels, compared with a drop of 7.3 million barrels for the previous five-year average for that period. By January 21, prices at Conway had vaulted to a 95-cent/gal premium to Mont Belvieu.

Strong demand surges, low inventories, and supply challenges have led several Midwest states to implement emergency measures to provide propane to heating customers, including suspensions of limitations on hours of service for propane-delivery truck drivers.

From early 2010 until November 2013, propane prices at Mont Belvieu, the nation's largest propane storage and market hub, have been higher than at Conway by as much as 30 cents/gal, prompting propane supplies to flow south on newly expanded southbound pipelines. High demand from the local petrochemicals industry and access to the global propane market via expanded HGL export capacity supported higher Mont Belvieu prices and encouraged propane from the Rockies (PADD 4) and elsewhere in the Midwest to flow south.

Read the U.S. Energy Information Administration report here. Visit the Star Tribune website here.

You might also like:

WASDE Report Suggests 2014 Could be a Banner Year for Pork Producers

You May Also Like