The amount of pork in freezers is beginning to be a bit concerning, especially when the fourth- highest level ever occurs on Sept. 30, just in front of what are usually the highest slaughter levels of the year.

October 29, 2012

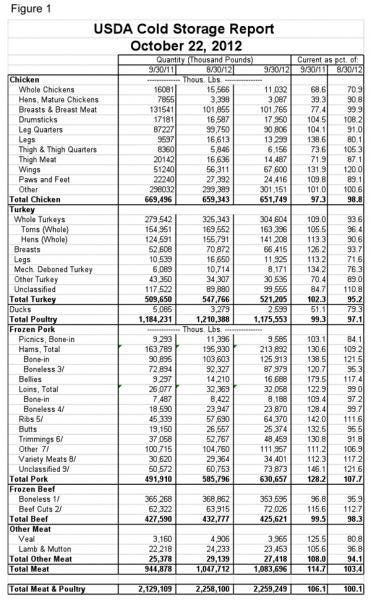

The amount of pork in freezers is beginning to be a bit concerning, especially when the fourth- highest level ever occurs on Sept. 30, just in front of what are usually the highest slaughter levels of the year. USDA’s October report indicates that there were 630.657 million pounds of pork and pork products in freezers at that time. That number is 28.2% larger than one year ago and 7.7% larger than at the end of August. The detailed data for all species appears in Figure 1.

Stocks were higher this year for all pork cuts, with bellies showing the largest percentage increase. But that increase was from a very low level last year and bellies accounted for just 7.4 million pounds of the 138.7 million pound year-on-year increase in total pork inventory. The culprit is hams with inventories just over 50 million pounds larger this year compared to last.

The second-largest unit increase was for “unclassified pork” at +23.3 million pounds or 46%. The second large increase for a single cut was for ribs – stocks grew by 19 million pounds or 42% from last year and 6.7 million pounds or 11.6% vs. last month. Rib movement has been slow all year and larger stocks in September are not an encouraging development as the last hurrah for grilling faded out as temperatures began to fall.

We normally look at freezer stock increases as a bad thing. Higher volumes in freezers usually serve as a lid on pork prices since any strength will draw supplies from freezers, thus limiting upside potential. And this increase in inventories could simply be the result of surprisingly large slaughter numbers in August and September. More hogs equal more pork and just so much of it can move to consumers in a given amount of time.

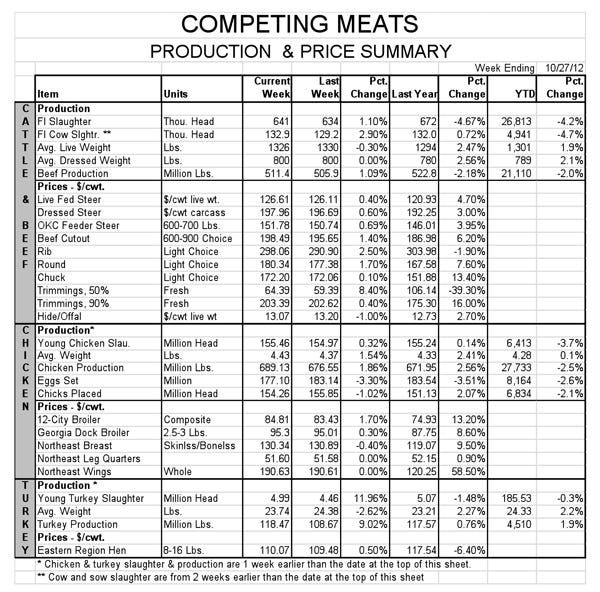

Trends with Other Meats

It is possible that this buildup is different. The beef industry has been downsizing for a while. Placements the past three months have been 11%, 10% and 19% smaller, respectively, than one year earlier.

The “choice” beef cutout was within pennies of its all-time high last week and will almost certainly eclipse the $200 mark this fall – trading as high as $215 or $220 next year, I think.

We saw the lowest broiler egg sets last week of any non-holiday week since 1986! Only Christmas week of 2011 had a lower number of eggs placed in incubators. The broiler breeder flock is at its lowest level since 1996.

The broiler cutout value that I compute has fallen seasonally since Sept. 1, but I expect it to rise rapidly after the first of the year and challenge its all-time high of $106.82 set in May 2004.

Turkey part prices are lower, but whole turkeys are hanging right at last year’s levels. Those statements imply that there are too many huge tom turkeys headed for boning lines, but about the right number of smaller toms and hens headed for Thanksgiving Day tables.

Competitive Alternative for Holiday Meals

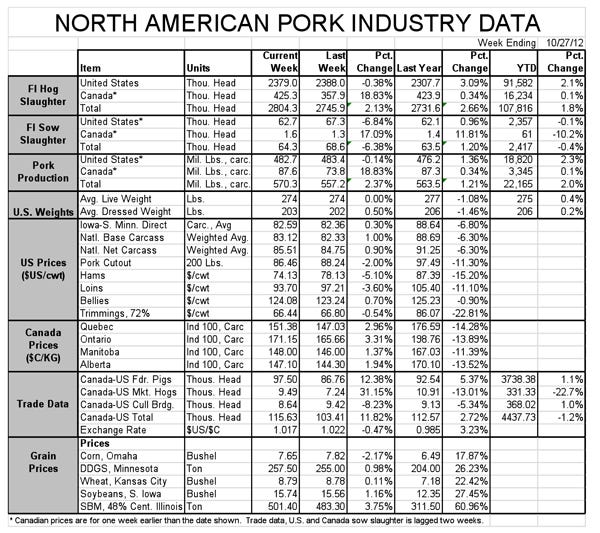

With all of that going on and pork prices lower than anyone expected them to be as recently as July, holding some pork stocks may not be a bad idea. Those hams in freezers are priced $10 to $20/cwt. lower than last year, depending on which weight class you look at. It appears to me that they may enjoy a competitive advantage relative to other proteins for the holidays.

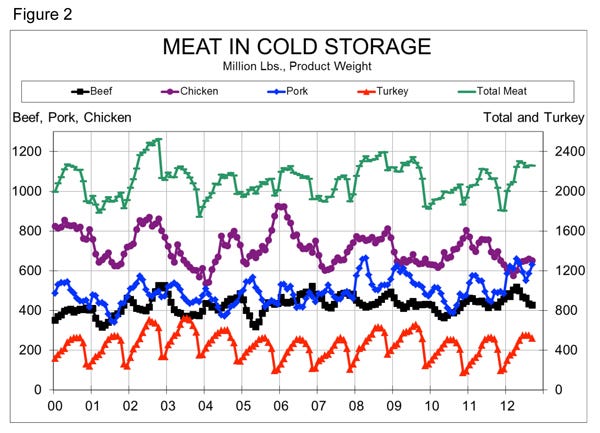

Figure 2 shows monthly freezer inventories for the four major species, plus all meat and poultry back to January 2000. The long-term uptrend of pork inventories is obvious and there is a good reason for it – pork production has trended upward as well.

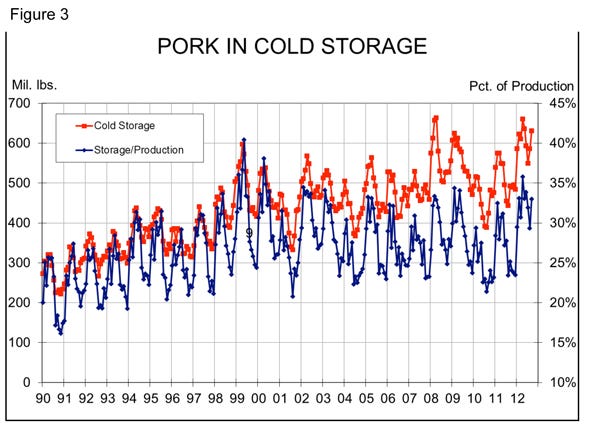

Figure 3 shows pork in cold storage and the percentage of monthly production represented by those inventories. Note that the values for 2012, though on the high side, are not close to the all-time highs for percent of production in cold storage and are actually right in the range of the seasonal highs since 2000. There is just one problem with that statement – those past highs did not happen in September! This year’s figure of 33% is far and away the largest ever for the end of September. In fact, the low of the year usually occurs in October, before the usual November and December flood of slaughter hogs pushes inventories higher. This year’s slaughter pattern may well be different, but it will likely take huge product movement this month to establish a seasonal low on Oct. 31. That level, even if it is reached, may well be the highest seasonal low ever.

Plan on serving ham for Thanksgiving and lots of other days. We have plenty.

About the Author(s)

You May Also Like