February 13, 2012

Perhaps the worst-kept secret in recent memory – U.S. pork and pork variety meat exports set new records in 2011. New records were actually reached in November, but it’s the magnitude of the record that is impressive and deserving of further attention.

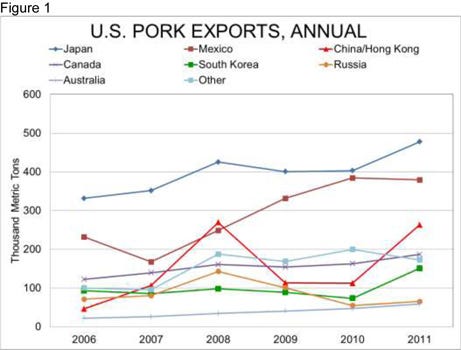

Figure 1 shows annual exports of pork muscle cuts to the top seven destinations in 2011, plus all “other” countries. Japan and Mexico are still the clear leaders among our markets for pork muscle cuts, taking 477,678 metric tons (526,401 tons) and 379,091 metric tons (417,758 tons) of pork, respectively, for 2011. Those figures were 18.5% higher and 1.3% lower, respectively, than were 2010 shipments to these two markets.

Shipments to Japan were driven by a record-strong yen that made U.S. product more affordable to Japanese processors and consumers as well as the increased needs for product that resulted from the earthquake and tsunami last spring.

Shipments to Mexico were hindered during the second half of the year by a lower-valued peso that increased the cost of U.S. pork to Mexican processors and consumers. The peso was roughly 16% less valuable relative to the U.S. dollar at the end of 2011 than it was the week of April 29, 2011. It has regained about 7% of that value since the beginning of the year.

While business with our historically largest markets was mixed, the key driver of the record year was another surge in shipments to China/Hong Kong. Pork muscle cut exports grew 134% over their 2010 level to finish the year at 262,753 metric tons (289,554 tons). That figure is just short of the 269,835 metric tons (297,358 tons) that China/Hong Kong purchased in 2008.

The question of whether China/Hong Kong is a dependable market remains, however. While the 2011 surge was not driven by a once-in-a-lifetime occurrence like the Olympic games, it was pushed by an unprecedented surge in Chinese food prices in general and pork prices in particular. Those prices were fueled by continuing disease problems in China’s hog sector as well as further increases in consumer buying power. Neither situation is likely to change soon and certainly will not disappear as quickly as did the Olympics. I think this increase may have some staying power, though I would be surprised by a complete repeat of these purchase levels in 2012.

This export surge was not “bought” with lower prices, either. The total value of pork muscle cut exports in 2011 reached $5.321 billion, 30.4% higher than in 2010 and 30.1% higher than the previous record set in 2008. Japan is the clear leader in export value at over $1.9 billion. Mexico ($815 million) and Canada ($712 million) rank second and third.

The average value of a ton of U.S. pork muscle cuts hit a record $3,034.03 last year, easily surpassing the previous record of $2,841.26 set in 2010. Last year’s average value was over 16% higher than the average value in 2008 when the last tonnage record was set. Higher volume and higher prices mean higher demand!

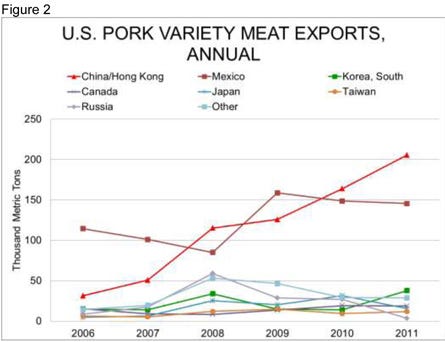

For pork variety meats, the race for the top has only two contenders: China/Hong Kong and Mexico (Figure 2). The two leaders accounted for over 75% of our tonnage and 74% of our value last year. China/Hong Kong was the largest market for our variety meats for the second year in a row with shipments growing by 25.5% last year to exceed over 205,000 metric tons (225,910 tons). The value of shipments sent to China increased by 48%. Like muscle cut exports, variety meat shipments to Mexico fell slightly (2.1%) in 2011, but the value of products sent south increased by 7.7%.

I have long been on record as saying that the variety meat sector is where China will have its greatest impact on the U.S. hog market. Consider that, even with this record, we shipped only 0.35 lb. of variety meats to China for each of its 1.3 billion people. I know Chinese cuisine doesn’t include much meat, but that is a very small amount. While the amount may not grow much, its value could increase dramatically over the next few years.

The bottom line is that muscle meat and variety meat exports accounted for $53.70 of value for every hog slaughtered in the U.S. last year. Throw in hog sausage casings and that value rises to $55.10/head, nearly $14/head more than the comparable figure in 2008.

Can this continue?

It darn sure better continue since our industry is geared to serve export markets. When stated on a carcass weight basis, we shipped 22.7% of all carcass weight pork production overseas last year. U.S. Meat Export Federation (USMEF) estimates that when you include variety meats and casings, that number rises to 27.5% of total muscle cuts, variety meats and casings. Absorbing those quantities or even a significant fraction of them in the U.S. market would drive prices significantly lower. We must continue our market access and foreign marketing efforts and do everything necessary to prevent export disruptions.

About the Author(s)

You May Also Like