How deep is the trouble for the U.S. pork market? There has been a lot of wailing and gnashing of teeth over the past few weeks as cutout values dropped below $80.

March 18, 2013

How deep is the trouble for the U.S. pork market? There has been a lot of wailing and gnashing of teeth over the past few weeks as cutout values dropped below $80. For us old-timers, that is a pretty remarkable statement, since prior to 2008 we had seen cutout values above $80 only a handful of times during the summer of 2004.

Now, I know, an $80 cutout value is not nearly what it used to be. Modern era corn and soybean meal prices and average costs in the $90s on a carcass weight basis mean that cutout values need to run near $100 (or even higher) for both producers and packers to make money, which both must do in the long run if this industry is to flourish.

But, again, I think we need to put this year’s prices in perspective. As President Harry Truman always admonished: “Study your history!” Granted, that’s certainly not as catchy as his notation: “No man should be president who does not understand hogs,” but knowing your history is probably a lot more useful in everyday life.

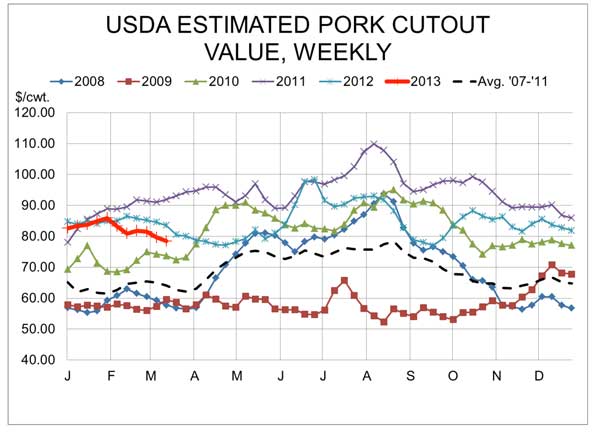

When we study the history of pork cutout values over the last few years, we discover that January through March has seldom been a period with much to celebrate. Figure 1 shows weekly average estimated cutout values from USDA since 2008. Since Jan. 1, the cutout value has been as high as $85.90 in the week that ended Feb. 1, then as low as last week’s $78.46. The net loss for the year has been $4.12/cwt. That is the largest negative change for Jan. 1 through mid-March since the cutout computations were changed back in 1998.

Figure 1.

But it is hardly the first negative change. In fact, this marks the sixth year in the past 16 years in which the cutout value has fallen over the first 11 weeks of the year. The average decline over the previous five years was $1.45/cwt. Four other years saw cutout values rise less than $4/cwt. during that time period. There have been three years (2001, 2004 and 2011) in which cutout values have gained over $10/cwt. during the period.

But notice the line for the average of the past five years. It indicates that, on average, the value in mid-March is about $1/cwt. lower than at the beginning of the year and that the cutout value continues – again, on average – to decline until the end of March when it hits a seasonal low about $3/cwt. below the value during the first week of the year. It is clear that the first quarter has not been, on average, anything to write home about since 2007.

But should we look at dollars per hundredweight or percentages to measure these changes since $3/cwt. today is not nearly as large of a relative change as was $3/cwt. in 2008, the first year of the five-year period? If you prefer, we could say that prices usually drop by about 1.6% by mid-March and bottom out 4.6% lower than the first week of January through the last week of March. Regardless of the units, the message is the same: While we all may have thought pork values would increase in February and March, such an increase would be more the exception than the norm. That’s the bad news.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

The good news is that over the past five years, the estimated cutout value has increased from a weekly low of $62.16 the last week of March to a weekly high of $78.39 the third week of August. That increase of $16.23 would put summer highs at $95-$96 this year. If the percentage increase holds, the summer peak would be roughly $99.

Neither of those cutout values would likely get hogs to $100 this summer, but I do believe that this year’s sideways seasonal pattern has been impacted by more negative news than is normal. Yes, February and Lent are the same as usual. But several significant snowstorms in heavily populated areas, the unjustifiable ractopamine trade actions of Russia and China, and a rapid and significant rise in the value of the U.S. dollar relative to the Japanese yen are hardly “normal.”

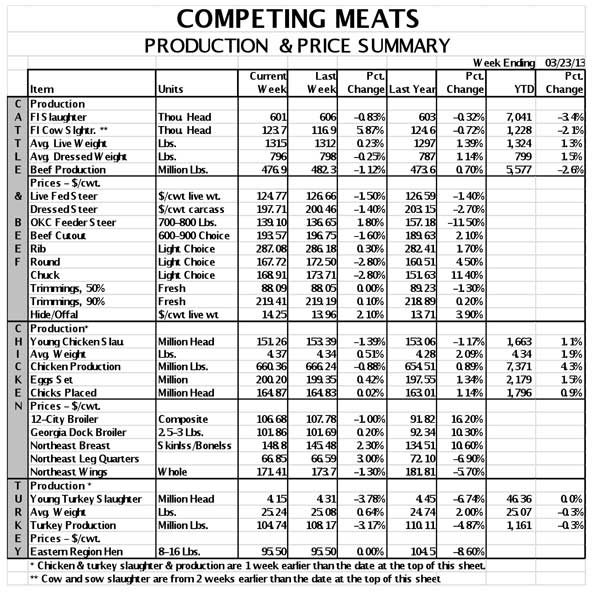

Finally, a key factor in our struggles may have reversed itself the week of March 9 when both the Choice and Select beef cutout values gained over $9/cwt. Each followed that strong week with another increase last week, putting the Choice value at $196.75 and the Select value at $195.27. I still believe both cutout values will move above $200 soon, creating some additional value opportunities for pork this spring as hog supplies tighten.

My “$100 cash hogs by summer” limb is getting a bit wobbly, but I think that level is still possible. Some of the negative conditions that have gotten us to where we are today must change. I think some, indeed, will. Hey, February is already gone, Lent ends soon and it has to get warmer eventually, right?

You might also like:

COOL Controversy Far From Over

Word to the Wise-Cover Your Corn Needs

About the Author(s)

You May Also Like