USDA released its final estimates for the 2012 corn and soybean crops on Friday. They, combined with the Dec.1 Grains Stocks report, were bullish indeed.

January 14, 2013

USDA released its final estimates for the 2012 corn and soybean crops on Friday. They, combined with the Dec.1 Grains Stocks report, were bullish indeed. The chief concern in the numbers is that usage has not been reduced enough to get to the end of this year with anything resembling comfortable inventory levels. This was not a huge surprise, but the report drove the point home.

I am compelled to repeat a warning I posed earlier: There are areas where you will not be able to find corn and soybeans this summer. The United States will not run out of grain, but buyers in some areas will have to spend more time and money finding and transporting their feed ingredient needs.

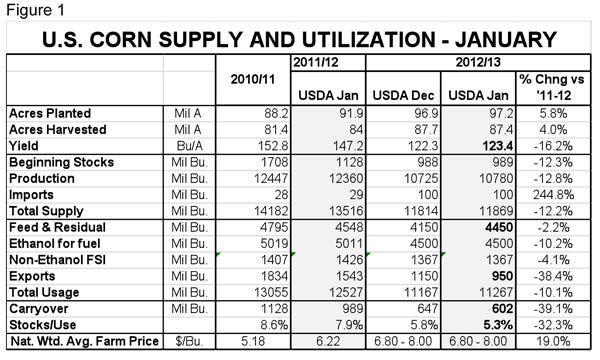

Figure 1 shows USDA’s final output data for the 2012 crop and latest usage projections for the 2012/13 crop year. They added just over a bushel to the estimated yield and increased harvested acres slightly from December’s report. The net impact was to raise the crop and total supply figures by 55 million bushels.

But that small increase in supply was taken away quickly with a 300-million-bushel increase in projected feed and residual usage. I wasn’t surprised. I had wondered all along just how the livestock and poultry sectors were going to cut enough feed usage to get to the previous estimate of 4.15 billion bushels. I suspect that the December Hogs and Pigs Report, which indicates total 2013 hog slaughter will be just a bit larger than last year, was the final straw for that low feed usage estimate. Add in positive financial reports from several broiler companies and the idea that feed usage was falling that far dies pretty quickly.

Yes, there are significantly fewer cattle on feed and feedlot placements will likely continue to lag behind year-ago levels. But there are far more feed ingredients that can be used to feed cattle, which means cattle numbers do not have the impact on corn usage that other species do. The 4.45 billion bushels is still 2% lower than last year but it looks far more reasonable to me.

USDA also reduced exports by 200 million bushels. According to Iowa State University’s Robert Wisner, that change has more to do with high corn prices, increased feed wheat availability and the size of Brazil’s late-season 2012 corn crop than it does with the water levels of the Mississippi River and the resulting navigation challenges.

USDA made no change to its projection for ethanol usage of corn, leaving it at 4.5 billion bushels. That level implies that ethanol plants will continue to produce roughly 34.25 million gallons per day – the same rate at which they have operated since July. That rate will result in about 12.53 billion gallons of ethanol being produced this crop year. At 2.8 gal./bu., that will take 4.475 billion bushels of corn. Close enough, I think.

The 12.53 billion gallons of ethanol output will fall roughly 1 billion gallons short of the renewable fuels standard (RFS) for the 2012-13 corn marketing year. I arrive at that figure by including four months at 2012’s 13.2 billion gallons and eight months at 2013’s 13.8 billion gallons to get an average of 13.6 billion gallons as an estimate of how much ethanol is required to be blended by the RFS for the coming crop year. No one knows just how many RINS (credits for prior-year blending above the required level) exist, but most believe it is in the range of 2 to 2.5 billion gallons, so this implies that about half of them will be used in this marketing year.

Next year the blending requirement goes to 14.4 billion gallons while, by every indication, gasoline usage by U.S. consumers continues to trend downward. I’m no genius, but I can see that that will not work. There may be enough RINs left over to get through 2014, but what happens in 2015 when the RFS goes to 15 billion gallons?

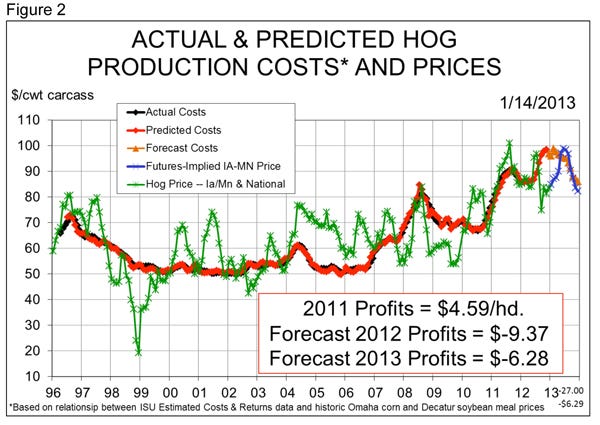

The net impact of the Grains Stocks report is to dim the outlook for profitability for this year. Figure 2 shows the results of my costs and returns model (based on Iowa State’s long-standing series) as of this morning. That projected loss of $6.28/head is far better than at times during the past six months, but it is nearly $5/head lower than just a week ago. Feed costs account for well less than half of the decline, though, as last Wednesday’s $2-plus fall in Lean Hogs futures was a big blow.

I’ve said for a while that we have probably not rationed enough corn usage for the remainder of this crop year. The World Agricultural Supply and Demand Estimates (WASDE) report more or less confirms that. Higher futures and a potentially wild corn basis still spell very expensive feed for the remainder of the crop year. Do you know where your corn for this summer is currently stored?

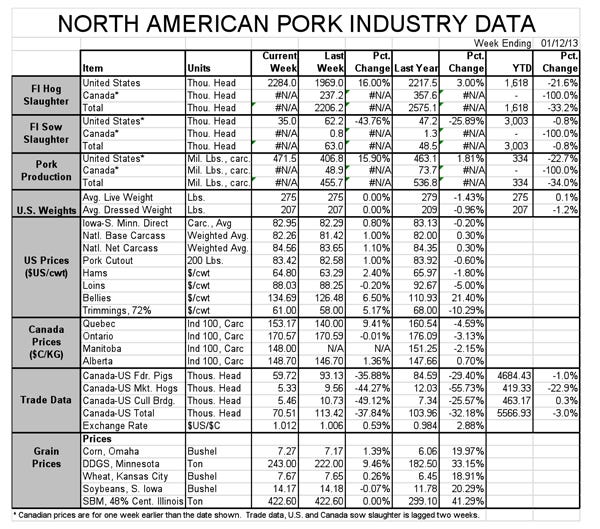

Pork Industry Data Table Footnote

We apologize for the missing values for Canadian and combined Canadian-U.S. slaughter in today’s data tables. The most recent data available from Statistics Canada at this point is for Dec. 29. We hope to have updated data next week.

About the Author(s)

You May Also Like